I have long been saying on this blog that our most serious national problem is the huge national debt, now over $32.4 trillion. And now, persistent inflation, coupled with a strong economy, is exacerbating this debt problem. Consider:

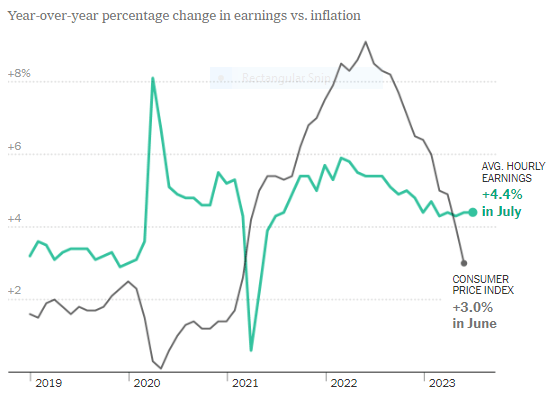

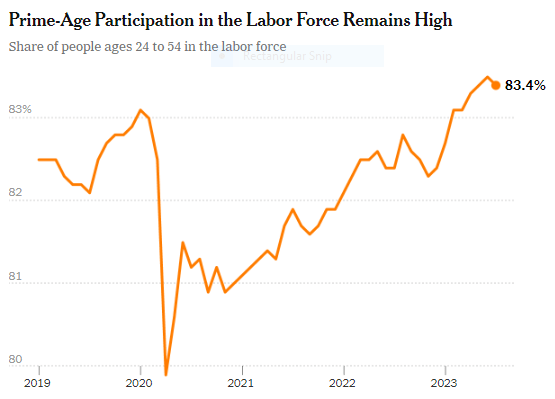

- Strong Economy. There were 187,000 new jobs created in July. Wage gains are finally, after two years, exceeding the increase in inflation. Job vacancies are high and exceed the number of unemployed. Labor participation rates are also high.

- Persistent Inflation. Although the Consumer Price Index (CPI) grew only 3% in June, core inflation (excluding food and energy) was a significantly higher 4.8%. And, of course, Fed imposed higher interest rates mean high mortgage rates, badly hurting the housing market.

- Huge Annual Deficits. The deficit for FY 2022 was $1.4 trillion. CBO estimates the 2023 deficit will be $1.7 trillion. And deficits are projected to keep rising in the future.

The problem in a nutshell. The $5 trillion Covid pandemic stimulus set off an inflationary spiral, beginning in Spring 2021. Belatedly the Federal Reserve has raised short-term interest rates to 5.25%. This has slowed down inflation but not yet back to the desired level of 2%. Either interest rates must go higher still, or the CPI will linger at a 3% or higher level. In the meantime, the higher interest rates have raised interest rates on our $32.4+ trillion debt which has massively raised interest payments on the debt. This greatly increases the annual deficits, which become part of the total debt. And the increasingly high deficits continue to overstimulate the economy, which, in turn, puts upward pressure on inflation.

The solution is clear. A strong economy does not need extra fiscal stimulus. Annual deficit spending must be greatly reduced. This may slow economic growth somewhat but, in turn, will make it easier for the Fed to bring inflation back down to the 2% level. In other words, the key to curbing inflation, and getting economic growth back on a sustainable course, is to greatly reduce annual deficit spending. This can be done if our national leaders are willing to spend the political capital to do it.

Conclusion. Our current combination of a strong economy, persistent inflation, and high annual fiscal deficits puts our country in a dangerous trap that could easily spiral out of control if not reversed. The key is to significantly reduce annual deficit spending, as described above.

For my Email Newsletter

Follow me on Facebook

Follow me on Twitter

Is it time to think about beginning to slowly implement a national strategy to progressively reverse the personal income ratio between the highest 10% and the lowest 25%, viz., Sweden?

A dynamic free enterprise society will always have income inequality. Our focus should not be to tear down those on top but rather to lift up those on the bottom. Of course, we are trying to do this already but perhaps we can figure out a more effective way to do this.