On this blog, I discuss important national issues, especially on fiscal and economic matters. Often this means discussing congressional and presidential policies, and where they are succeeding or not succeeding.

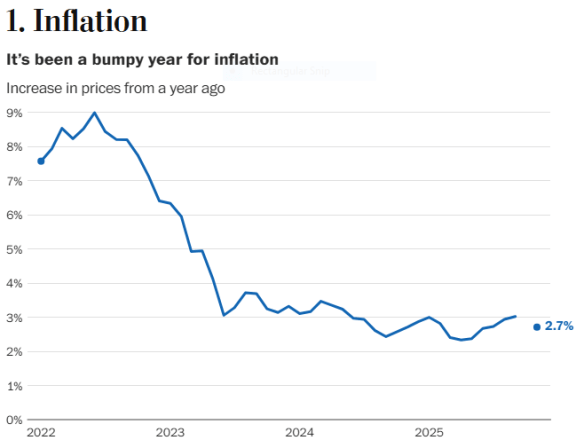

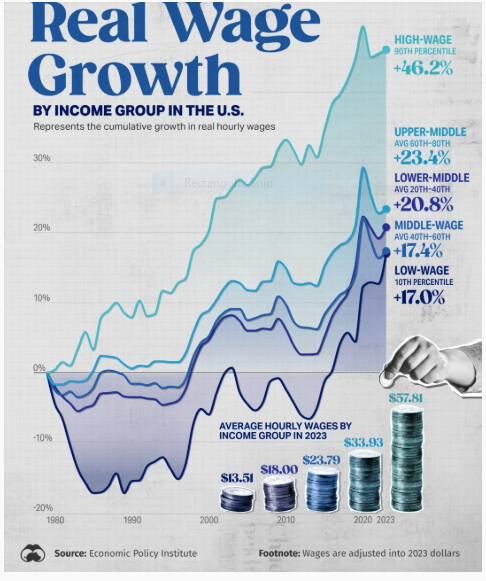

Today, I discuss the fact that inflation is still too high and is taking a big bite out of typical worker incomes. Consider:

- Inflation is up 25% since before the pandemic. It is still rising at an annual rate of 2.7% overall, which is too high. Of course, many individual prices are rising at a much faster rate.

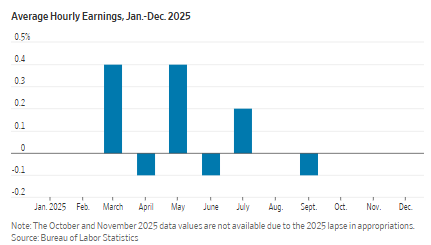

- Affordability is a real problem for many Americans. In the past year, as the chart below shows, average wages have not kept up with increases in inflation.

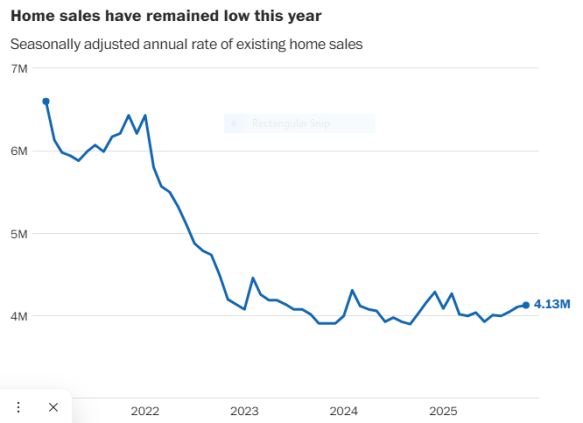

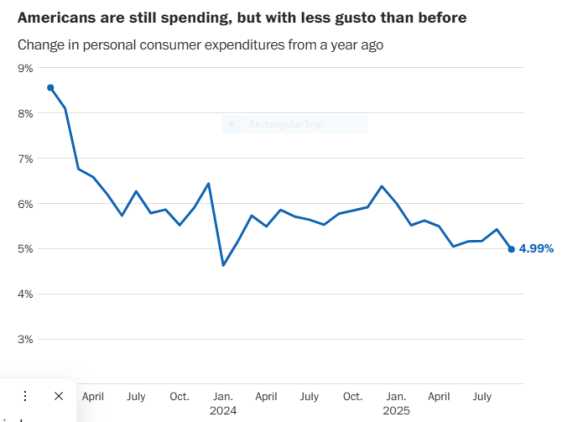

- Other indications of stress are flat home sales, at a time of housing shortage, and low consumer spending, which indicates consumer caution.

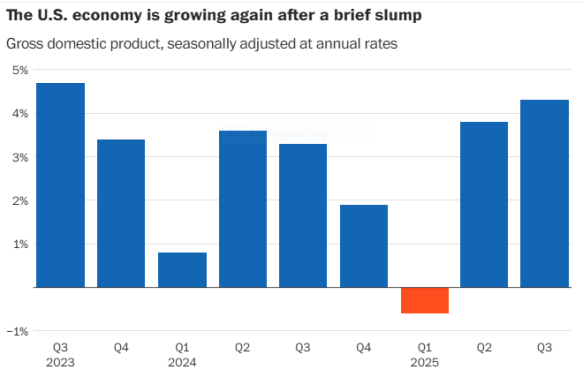

- Economic growth is strong, which is, at least, one positive counter-sign.

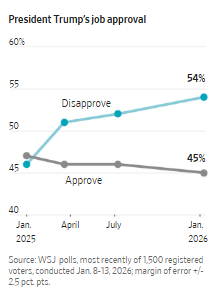

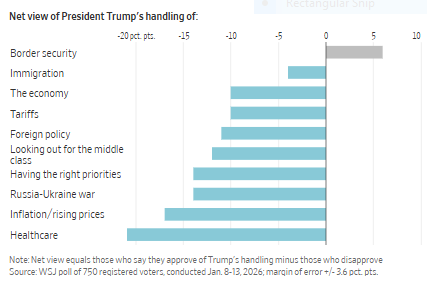

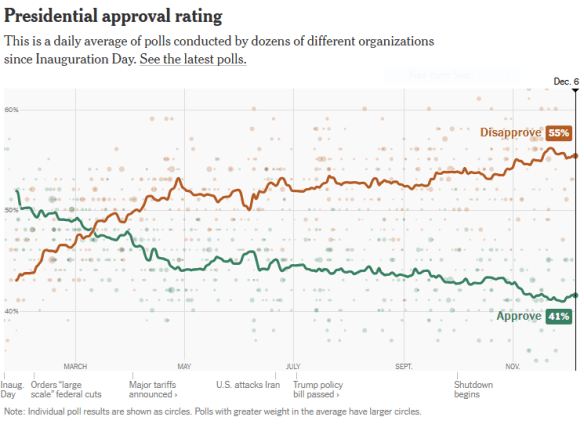

- Trump’s overall job approval is low, which is primarily a result of the affordability problem. He needs to direct more attention to this problem.

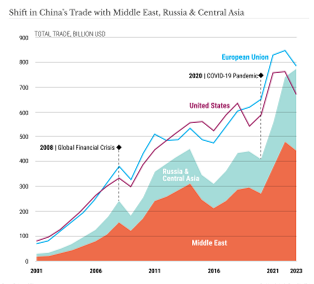

Conclusion. Not only is inflation up 25% since before the pandemic, it is still rising at an annual rate of 2.7%, faster than typical wage growth. This creates an affordability problem for many Americans. This, in turn, creates a political problem for President Trump, who is currently in charge. He clearly needs to give more attention to the affordability problem in one way or another, perhaps by backing off even more on his arbitrary and capricious imposition of tariffs.