On this blog, I discuss major national issues, often, but not always, focusing on economic and fiscal issues. I have recently criticized President Trump for letting spectacle get in the way of substance.

Today, I discuss why I support Trump’s decision to join with Israel in attacking Iran’s entire military structure, including its nuclear weapons infrastructure, as well as its missile and drone facilities.

Consider:

- Iran has been spreading terror throughout the Middle East and killing Americans, over and over again, ever since 1979.

- Venezuela was conducting drug trade by smuggling cocaine into the U.S. So we took out the illegitimate president (Maduro) and are leaning on his lieutenants to cooperate in restoring oil production as well as restoring democracy.

- This is the Trump Doctrine and is now being applied in Iran as well. We have taken out the top leadership (Ayatollah Khamenei) and are destroying Iran’s entire military infrastructure.

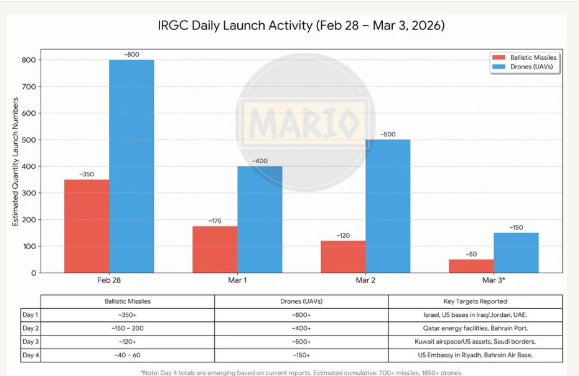

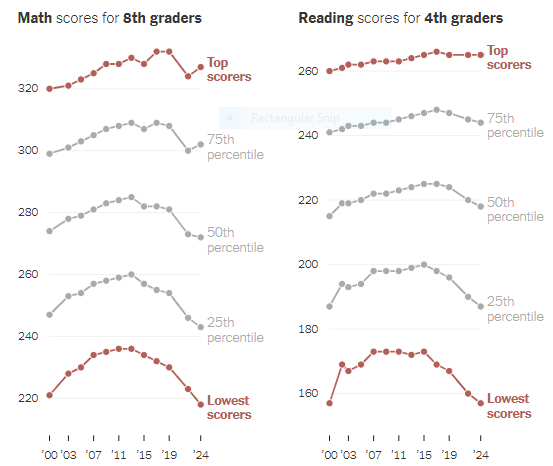

- The operation is rapidly destroying Iranian military facilities (see chart below) and is likely to be completed in just a few more days.

- The Trump Doctrine avoids boots on the ground. We want regime change, but we do not invade other countries to achieve it.

- The Trump Doctrine builds on long-standing American foreign policy tradition. We are not isolationist and we are not imperialistic (looking for land to annex). But we do intervene in specific problems around the world in order to protect our vital interests and to promote and defend democracy.

Conclusion. In Venezuela and now in Iran, we have shown that we are willing to intervene to protect our national interests as well as to protect democracy when it is threatened.