My last post pointed out that the currently strong economy, stimulated by huge deficit spending, is likely to keep inflation higher for a longer period of time. This means higher interest rates which, in turn, means much higher interest payments on our rapidly exploding debt, leading to even higher annual deficits. This is a vicious trap we have fallen into. It is critical to take immediate steps to turn this perilous situation around.

Here is the latest data which reinforces this pessimistic view of our current situation. Consider:

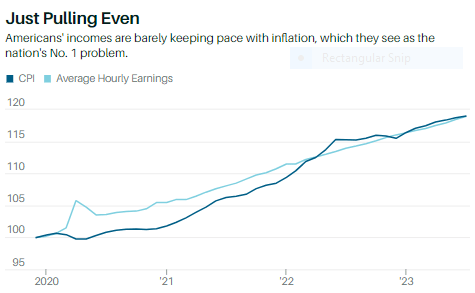

- Interest rates and the Federal Reserve. The CPI is up to 3.2% for July, “only” slightly higher than June’s 3.0%. But core CPI, excluding food and energy prices, is still higher at 4.7%. And the price of gas has risen significantly in the past few weeks. In other words, the Federal Reserve will likely decide to raise interest rates even higher later this year. And, of course, this is in addition to the damage inflation is already causing by negating wage increases (see chart).

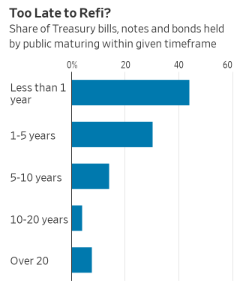

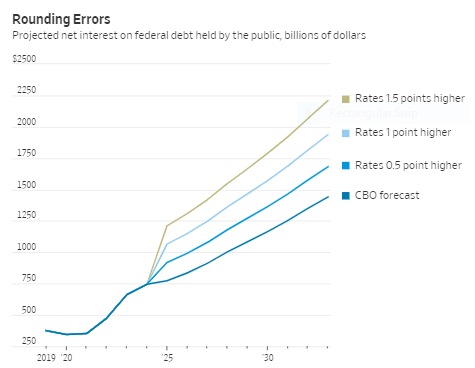

- The likely rapid increase in interest payments on the debt. This is the scary part. The first chart shows that over half of the U.S. treasury bonds financing our national debt come due within the next few years. This means that they will soon be rolled over at much higher interest rates. Based on the current 5.25% short-term interest rate, CBO projects that interest payments on the debt will reach $1 trillion per year by 2028. If interest rates rise only .5% more, interest payments will reach $1 trillion by 2026. And of course, interest payments continue to rise sharply after that.

- In FY 2023 (this year), interest payments will be almost $700 billion out of a total debt of $1.7 trillion (as estimated by CBO). In other words, deficit spending, without including interest payments, is already hitting $1 trillion annually and rising. Simple arithmetic shows that our total annual deficit could hit $2 trillion by 2026 as it continues upward. This is scary!

Conclusion. Inflation (with concurrent increases in interest rates by the Fed) is making our annual spending deficits grow much faster than otherwise. This, in turn, overstimulates the economy which is already growing nicely. Which, in turn, causes inflation to stay higher for longer. We have created a vicious circle feeding on itself. We need to break this harmful cycle as quickly as possible. Significantly lowering annual deficit spending is the only way to do it!

For my Email Newsletter

Follow me on Facebook

Follow me on Twitter

Meanwhile back at the store, our nation’s social cohesion continues to worsen from our nation’s political paralysis in Washington: viz., homelessness, decreasing longevity, adolescent suicide/homicide, childhood traumatic events, and unsafe neighborhoods.

There will always be problems of social cohesion in a democratic and free-enterprise society. Of course, we need to constantly pay attention to these problems, as I think we do for the most part. But now we have a looming existential problem as well, namely our out-of-control national debt. Solving this very serious problem needs to be the main focus of our attention until it is gotten under control.

Sir Arnold Toynbee said long ago: “Of the twenty-two civilizations that have appeared in history, nineteen collapsed when they reached the moral state the United States is in now.”

Which are the three which did not collapse when in our present state, and did even they collapse later? I tend to think that it would be our fiscal state, rather than our moral state, which could lead to our collapse. This question could be a good topic for a future post!