Neither presidential candidate for President, Kamala Harris nor Donald Trump, has expressed concern about our enormous national debt of $35 trillion, nor our annual deficit spending now approaching $2 trillion per year and growing. This, of course, is a dereliction of duty on a grand scale by both candidates. This being the case, voters will have to try to figure out as best they can who will be the best steward of the economy for the next four years. It is assumed below that Harris’s economic policies are likely to be a continuation of Biden’s.

Consider:

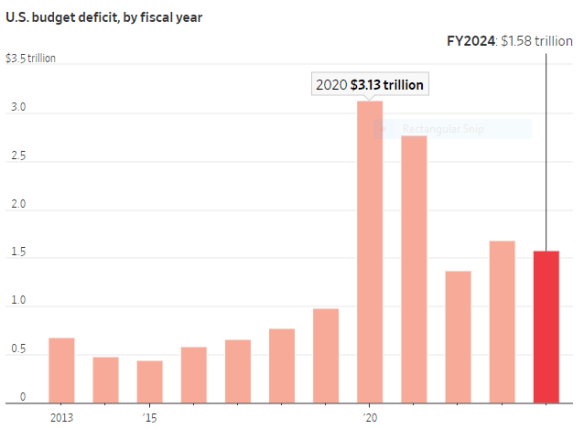

- Deficit spending. Deficits under Trump (fiscal years, 2017 – 2020) totaled $5.5 trillion while under Biden (fiscal years 2021 – 2024) they have totaled $7.6 trillion. And this includes a major Covid spending year for each, 2020 for Trump and 2021 for Biden. Score one more point for Trump.

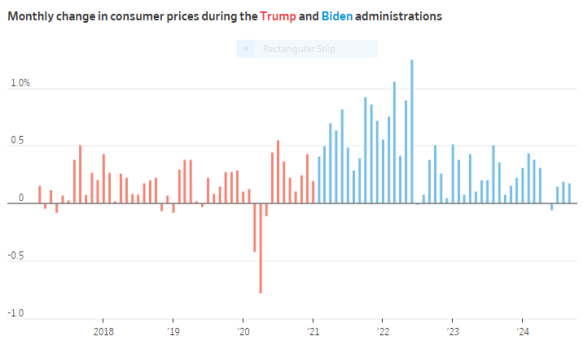

- Inflation. There was little inflation under Trump and the CPI (consumer price index) was 1.4% when Biden took office in January 2021. The new Democratic Congress then passed the $1.9 trillion American Rescue Plan, signed by Biden, and inflation immediately started rising and reached over 9% in 2022. It has now dropped back to 2.4% for September 2024. Even though excessive quantitative easing by the Federal Reserve made inflation more likely, it is still correct to say the Biden Administration tripped off our current round of inflation. Score one more point for Trump.

- Tariffs. Trump’s proposed major increase in tariffs would be anti-growth, but would not be inflationary. Tariffs increase relative prices in specific goods or industries but do not increase general price levels (which is the cause of inflation). Trump’s first-term tariffs hurt economic growth but were not inflationary. Score ½ point for Harris who will probably keep the existing (lower-level) Biden tariffs.

- Taxation. Trump has proposed several tax cuts (on tip income, social security income, overtime pay income, increasing SALT deductions, and deducting interest on car loans) none of which have good economic motivation and are unlikely to be approved by Congress. Harris wants to rate the corporate tax rate from 21% to 28%, which is a bad idea. Trump will approve extending the present 21% corporate tax, a good idea. Declare a draw on tax policy and spending.

Conclusion. Trump is likely to have better economic policies than Harris. His deficit spending should be less which means a smaller chance of reigniting inflation. His unilateral and universal tariff proposals are a bad idea. Hopefully, they will serve primarily as a bargaining tool to encourage lower tariffs from our democratic allies.

For my Email Newsletter

Follow me on Facebook

Follow me on Twitter

Your name:

Sharon Conlon

Your email:

sharonconlon@msn.com

Comments:Institue on Taxation and Economic PolicyCorporate Taxes Before and After the Trump Tax Lawhttps://tinyurl.com/ajkbcxpp

Thankyou for your comment on my above post about the economic policies of Harris and Trump. My response is that the 2017 Tax Reform under Trump was highly beneficial for the U.S. economy because it lead to increased domestic investment by U.S. domestic firms: https://www.wsj.com/articles/the-trump-corporate-tax-reform-worked-7670b723