On this blog, I discuss important national issues, especially fiscal and economic matters. Lately, I have been especially comparing the strengths and weaknesses of the Trump and Biden agendas.

Today, I will discuss the idea of taxing wealth, in addition to income. Senator Bernie Sanders of Vermont supports doing this. I have no intrinsic opposition to making the ultra-wealthy pay higher taxes. Billionaires, for example, could easily afford a 1% or 2% annual tax on their great wealth. The problem, in my view, is the difficulty of implementing a wealth tax. Consider:

- Firstly, how is wealth defined? If wealth consists solely of stock market holdings, then it could, for example, be measured by stock market values on the last day of the year. But how about financial holdings not invested in the stock market, such as in private companies? Or wealth held by ownership of real estate, or even in art collections? Establishing a fair evaluation of such forms of wealth would be highly subjective and subject to extensive litigation. And the existence of a wealth tax would encourage the very wealthy to attempt to hide their wealth in tax shelters, which are already a problem even without a wealth tax.

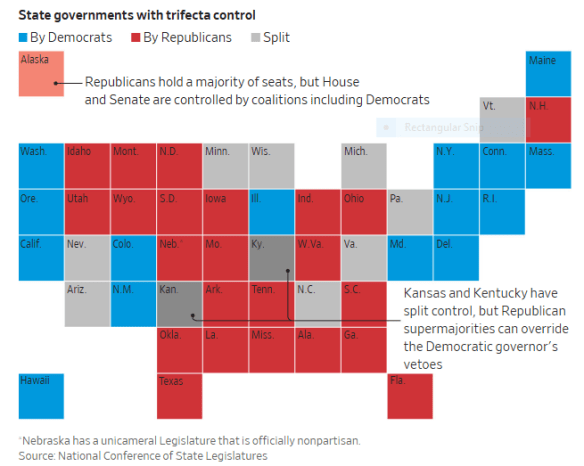

- Secondly, a wealth tax would be unconstitutional. The Sixteenth Amendment to the Constitution authorizes the taxing of income, “from whatever source derived,” which does not include wealth itself. Of course, the Constitution could be amended to authorize the taxing of wealth. But this requires the votes of two-thirds of both the House and the Senate, unlikely in our closely divided Congress, when most Republicans would surely be in opposition. And, even in the unlikely event that such an Amendment were proposed by Congress, it is unlikely to be ratified by three-fourths (38) of the states. As I have previously discussed, 25 states have effective trifecta control (both legislative branches and the governorship) by the Republicans and only 15 by the Democrats. Again, this means that it would be virtually impossible for a Constitutional Amendment taxing wealth to be ratified by the required 38 states.

- Thirdly, our annual spending deficits are running at about $2 trillion and must be greatly reduced. But this can and should be done primarily by cutting federal spending. Annual spending was about $5 trillion a year before COVID and has now ballooned to over $7 trillion. Taking recent inflation into account, it needs to be cut back to the vicinity of $6 trillion. Debt is the big problem, not inequality.

Conclusion. I have no intrinsic problem with making the wealthy pay greater taxes, but a direct tax on wealth, as opposed to income, will not work. Firstly, it is inherently difficult to measure wealth in an objective manner. Secondly, a wealth tax would be unconstitutional. Thirdly, our real problem is debt, not inequality.