As I often say on this blog, I am optimistic about the future of America. But, of course, we do have big problems that must be overcome for us to continue to be the strongest country in the world. Consider:

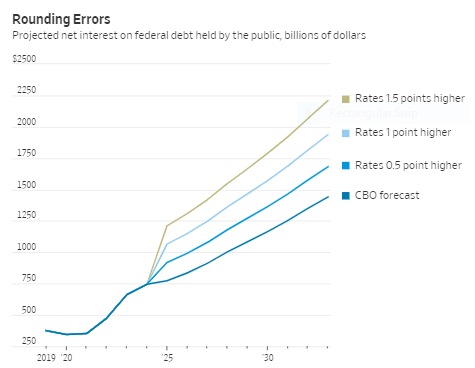

- It appears more and more likely that the 2024 Presidential election will be between Joe Biden and Donald Trump, two of the poorest Presidents in American history. I say this because neither of them is willing to take our exploding national debt problem seriously.

- I voted for Clinton in 2016, because of the Trump sleaze factor, but for President Trump in 2020 because I thought he did well in his first term (tax reform, deregulation, good judicial appointments). But his election denialism about 2020 has made him a huge liability to the Republican party. Trump’s many poor endorsements in 2022 cost Republicans control of the Senate in the current Congress.

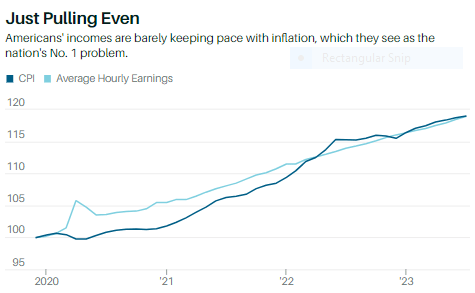

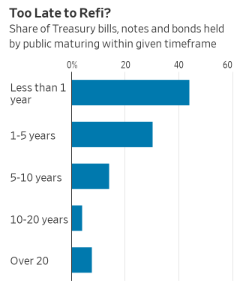

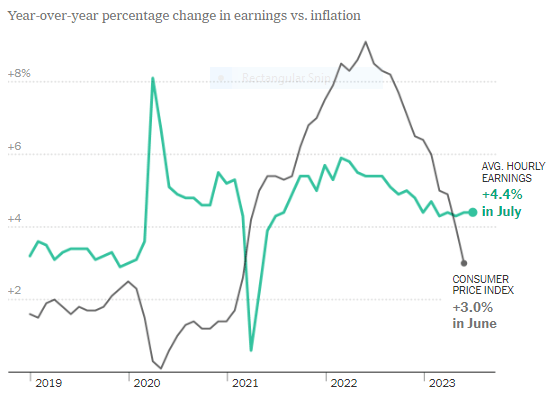

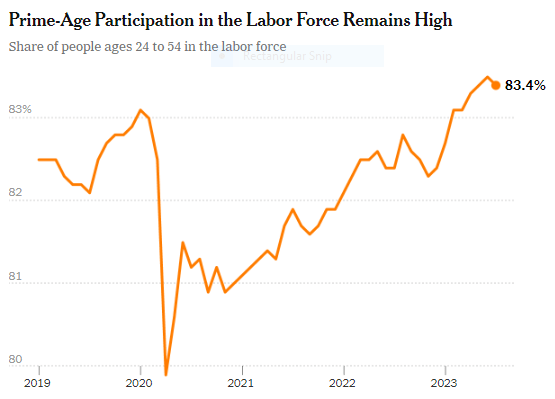

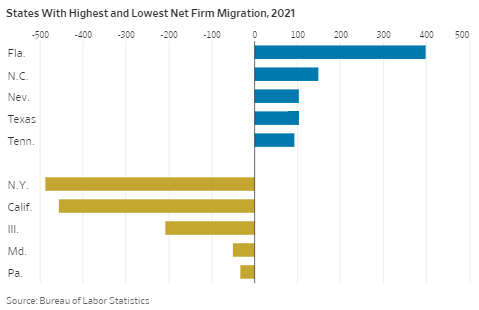

- President Biden has done some good things in foreign policy like supporting Ukraine and improving relationships with our Asian allies to make us better able to contain China. But Bidenomics is a disaster, see here and here. The Biden Democrats not only tripped off inflation with the $1.9 trillion American Rescue Plan in March 2021; but now are prolonging inflation with continuing huge annual spending deficits ($1.4 in FY 2022 and $1.7 trillion in FY 2023, as projected by CBO).

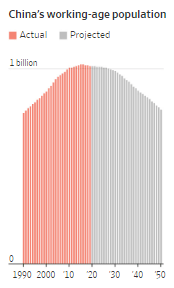

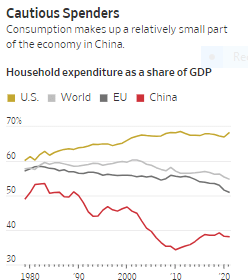

- Our biggest adversary, China, is stumbling badly with its economy. Its working-age population is beginning to fall dramatically because of its (now-discontinued) policy of one child per family. It also needs a faster transition to a consumer-led economy, such as the U.S. has, to make growth more sustainable in the long run.

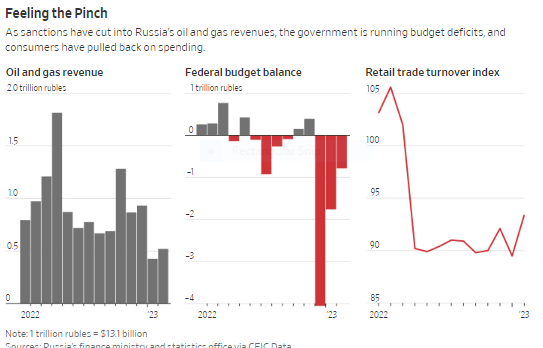

- Because of Russia’s disastrous invasion of Ukraine in February 2022, its economy is now in decline, as pointed out by Evan Gershkovich in his now-famous WSJ article (which is likely why he is now in Russian jail).

Conclusion. We may be in store for five more years of poor presidential leadership. But our free and open democratic system is so superior to China’s and Russia’s that we should be able, nonetheless, to continue our upward trajectory of growth and progress. China and Russia have autocratic political systems and so for them, poor leadership does great damage to their societies (because it is almost impossible to challenge from within).

For my Email Newsletter

Follow me on Facebook

Follow me on Twitter