As I like to remind readers, I am a non-ideological fiscal conservative. I am not hard core anything. I just want to find practical, workable solutions for difficult and complicated problems. There is basically only one exception to my generally moderate outlook. I detest huge amounts of deficit spending except for unusual circumstances. Most of the time we should be willing to either raise taxes and/or cut spending to do what needs to be done and to live within our means.

This is why the current efforts by the Budget Committees of both the House and the Senate to devise a plan to balance the budget, i.e. eliminate deficit spending, over a ten year period is so exciting to me.

An analysis in today’s New York Times suggests that Congress should be content to just extend the so-called Ryan-Murray Budget from 2014-2015. “Ryan-Murray didn’t decisively move the needle one way or the other, which is why it was able to attract bipartisan support. Rather it preserved the status quo. In a world of divided government and polarized politics, keeping the government running without a lot of brinkmanship and high drama may be the best we can hope for.”

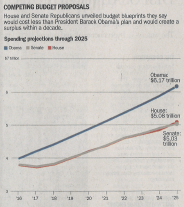

As I pointed out in my last post, current policy will raise government spending by 5.1% annually over the next ten years. The President wants to increase spending by an additional $1 trillion over this time period. The Republican budgets, which lead to balance in ten years, still allow spending to increase by 3.3% annually. The difference between the two plans is illustrated in the above chart from last Sunday’s Omaha World Herald.

As I pointed out in my last post, current policy will raise government spending by 5.1% annually over the next ten years. The President wants to increase spending by an additional $1 trillion over this time period. The Republican budgets, which lead to balance in ten years, still allow spending to increase by 3.3% annually. The difference between the two plans is illustrated in the above chart from last Sunday’s Omaha World Herald.

Congress is finally in a position this year to start digging us out of the deep fiscal hole we have fallen into. Let’s hope that too much “bipartisan” status quo thinking doesn’t get in the way of progress!