On this blog, I discuss important national issues, often dealing with economic and fiscal matters. With the murder of Charlie Kirk, conservative leader of Turning Point U.S.A., several days ago, I change my tone today.

Mr. Kirk was the embodiment of civil discourse. He wanted to debate issues, not defame his political adversaries. How should we all as individuals respond to this tragedy?

- Clearly, we should try to follow the example that Charlie has set. We should continue to express our views as clearly and forcefully as we can, but without disparaging either the motives or the character of those who disagree with us.

As President, Donald Trump could also try to set a more civil tone of political discourse and behavior. For example, he could:

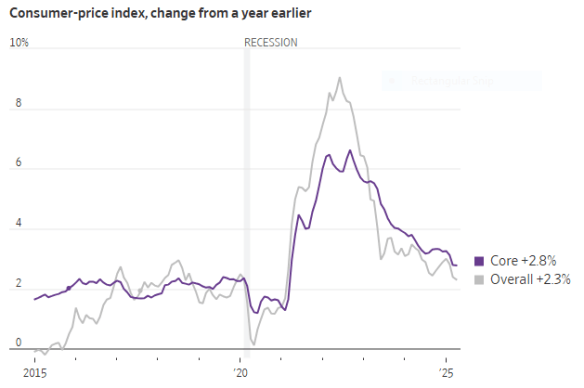

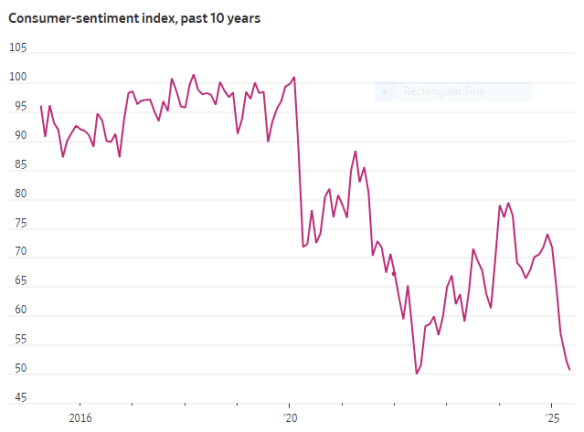

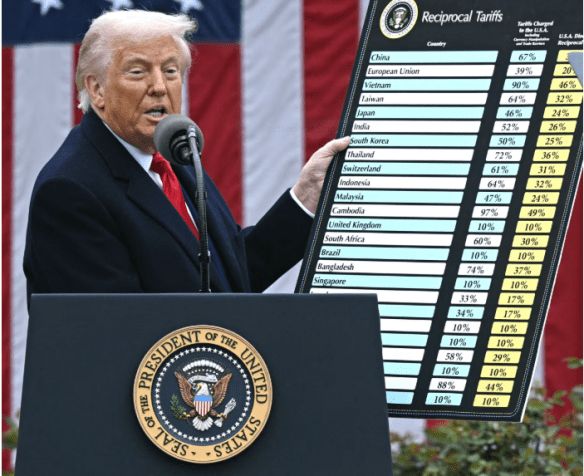

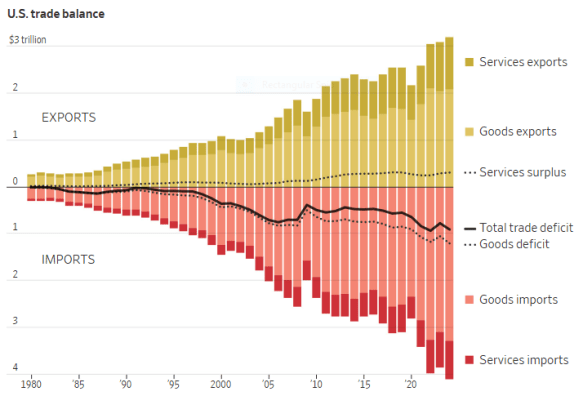

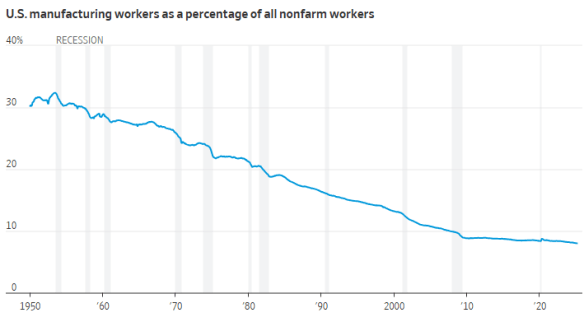

- Tone down the rhetoric and implementation of tariffs, especially on our democratic allies around the world. This would remove much of the uncertainty that is currently disrupting the economy and making inflation worse than it would be otherwise.

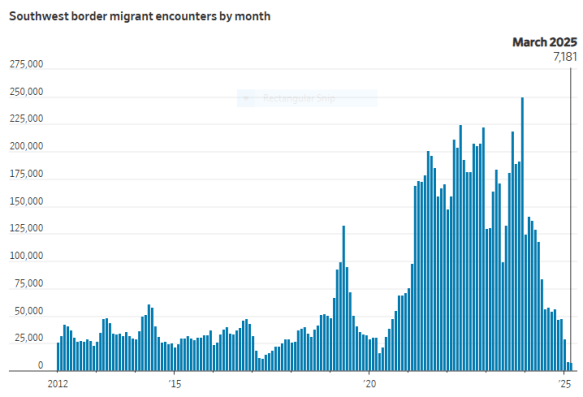

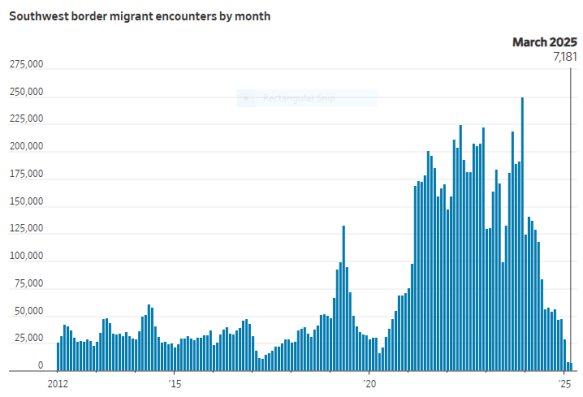

- Cut back on ICE enforcement raids on critical industries. The raid on the South Korean Hyundai Battery Plant in Georgia was especially harmful, considering that the Administration is trying to work out a big trade agreement with South Korea.

- Shift attention from tariff and immigration issues to foreign policy issues such as the Israel/Gaza and Russia/Ukraine situations, which would benefit from strong and decisive US intervention, see here and here.

Conclusion. Let’s honor Charlie Kirk’s memory by attempting to make his murder a real turning point in American political discourse. Everyone, from political leaders to ordinary American citizens, can contribute to making this a reality by toning down our own rhetoric.