My last several posts have discussed some of our society’s biggest problems in terms of their relative seriousness and how likely we are to make progress in solving them in the near future. For example:

- Global Warming. The evidence for man-made global warming is overwhelming (shrinking arctic sea ice, rising sea levels, more intense hurricanes, more devastating forest fires, etc.). But a growing number of Americans (now 70%) agree that urgent action is needed to address global warming and our political system is already responding on a state and local level. The Republican Party is already starting to get the message.

- Stagnant Middle Class Incomes. How to boost incomes for the working class is now a hot political issue. Do we need faster economic growth or more redistribution or a combination of the two? My own answer is to push for more inclusive economic growth by enhancing the Earned Income Tax Credit with a Wage Subsidy to give a bigger boost to all working people at the lower end of the income scale. The EITC already subsidizes wages to some extent and there is bipartisan support for expanding this program.

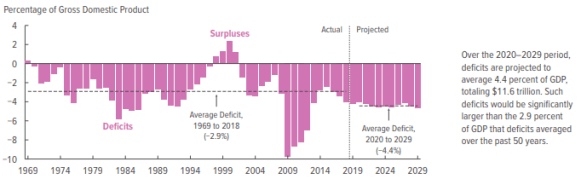

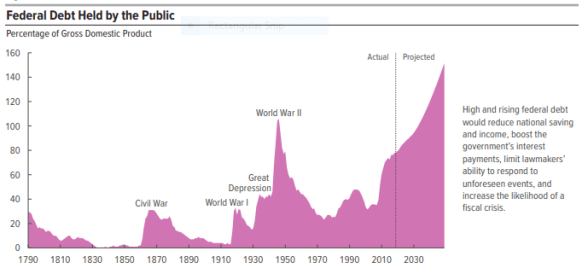

But our national debt is continuing to get worse and worse with no plausible solution in sight. The public debt (on which we pay interest) now stands at $16.6 trillion or 78% of GDP and is projected by the Congressional Budget Office to keep growing rapidly until serious reforms are undertaken. The longer we wait the more difficult the necessary corrective actions become.

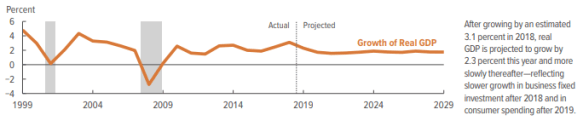

For example, CBO predicts that our annual deficits will settle down to an average of about 4.4% of GDP from 2019-2029 (see chart). At the same time GDP from 2020-2029 may only average 1.7%, much too low to keep up with the larger deficit levels. In addition the net interest rate on the debt will likely increase to 3% by 2029. (see chart).

All of this adds up to a spectacular debt increase over the next 30 years (see chart) which will almost certainly produce a severe fiscal crisis long before we reach the end of this time period.

What makes this problem so difficult is that neither political party wants to address it seriously because it can only be done by raising taxes broadly or curtailing entitlement spending. Both alternatives require sacrifice on a large scale which is difficult to accomplish politically.

Stay tuned for more details on what to do!