For the past two weeks I have been I have been complaining about Congress’s irresponsible budget for 2016 and that we should now be pushing hard for a Balanced Budget Amendment to the Constitution. In my last post I make the case that a flexible BBA is compatible with economic growth and will, in fact, contribute to it once it goes into effect.

Friday’s job report for December strengthens this argument:

Friday’s job report for December strengthens this argument:

- In 2015 there was an increase of 2.65 million new jobs only slightly less than 2014’s 3.15 million new jobs, the two best years for job growth since 2000.

- The current unemployment rate of 5.0% is the best since the end of 2006.

- Although wage growth at 2.4% for 2015 is not as strong as the early 2000’s, wages have now been climbing 2% faster than price inflation for the past three years.

- The offsetting negatives are a still slow GDP growth estimated at 2.2% for 2015 and a still very low labor participation rate of 62.6%.

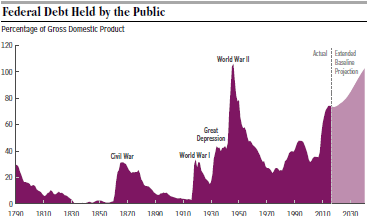

Conclusion: At some point in the very near future the government needs to stop spending far in excess of tax revenue. The sooner we recognize this the easier it will be to make the necessary correction. Our economy is the strongest it has been since the end of the Great Recession in June of 2009. Getting government spending in better sync with tax collections will be a big challenge and will not happen overnight. In fact, if a BBA is required to get the job done it will take several years to implement this route to fiscal responsibility.

For all of these reasons now is the time to start moving on this gigantic and festering problem!