“The Congress, … , on the application of the legislatures of two thirds of the several states, shall call a convention for proposing amendments, which shall be valid to all intents and purposes, as part of this Constitution, when ratified by the legislatures of three fourths of the several states, or by conventions in three fourths thereof …”

Article V, The U.S. Constitution

As I pointed out in my last post, under the current 2016 federal budget, just adopted by Congress and signed by the President, our public debt (on which we pay interest) is now projected by the Congressional Budget Office to increase from 74% of GDP today to 175% of GDP in 2040, just 25 years from now.

Of course, a new, and more severe, financial crisis is likely to occur long before we hit such a high level of debt but this serves to emphasize the extreme seriousness of our present situation and the need to address it without delay.

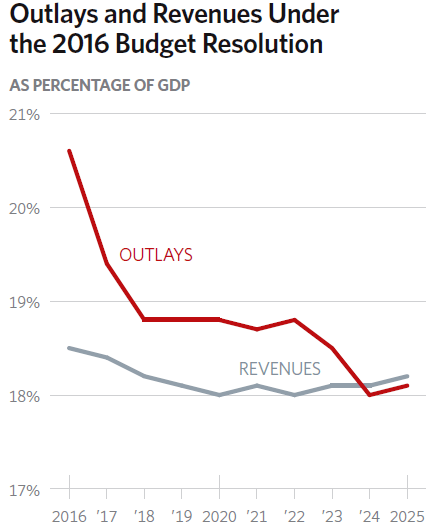

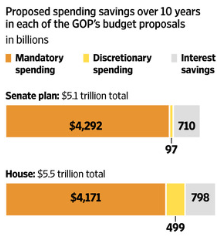

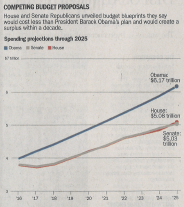

The best and simplest way to do this is for Congress to act on its own accord to pass balanced budgets. In fact, the current Congress passed a multi-year budget plan last Spring which leads to a balanced budget in ten years, by 2025. But the budget just passed last week for 2016 totally ignores this plan and actually increases the deficit for 2016 by $158 billion.

In other words, Congress on its own accord appears incapable of acting in a fiscally responsible manner.

As shown above, our founding fathers foresaw the possibility of congressional stalemate and provided for an alternative route to force Congress to act on critical issues. As reported by the Balanced Budget Amendment Taskforce, 27 states have already called for a Constitutional Convention out of the 34 needed to force congressional action.

As shown above, our founding fathers foresaw the possibility of congressional stalemate and provided for an alternative route to force Congress to act on critical issues. As reported by the Balanced Budget Amendment Taskforce, 27 states have already called for a Constitutional Convention out of the 34 needed to force congressional action.

In my next post I will discuss in detail the ramifications of holding a constitutional convention, pro and con.

Merry Christmas!

Follow me on Twitter: https://twitter.com/jack_heidel

Follow me on Facebook: https://www.facebook.com/jack.heidel.3