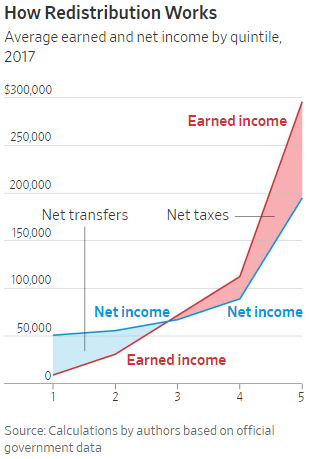

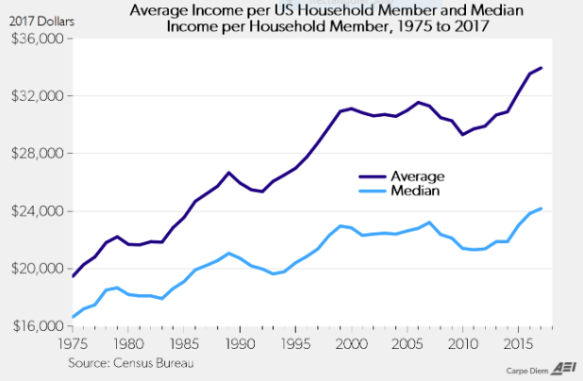

My last post points out that there is a relatively small degree of income inequality in the U.S., not nearly as bad as is commonly portrayed by the media, after taxes and government transfers are taken into account. Nevertheless, it would represent progress if low-income people could earn higher salaries and not have to depend so much on government welfare programs to boost their disposable incomes.

How can this be accomplished? A new book, “Unbound” by Heather Boushey makes a number of practical suggestions:

- Increase early childhood education opportunities. “Children’s test scores at age seven can explain 4 percent to 5 percent of the variation in employment at age thirty-three.”

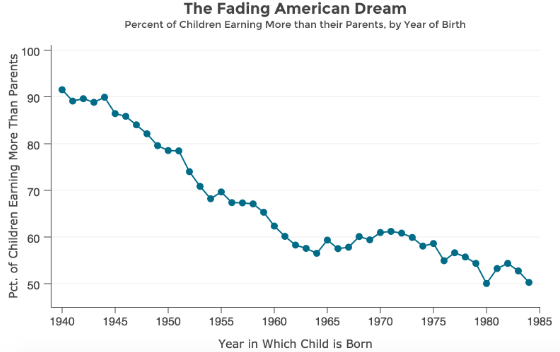

- Increase social mobility. A child is better off in an environment “less segregated by race and income, with a strong middle class, better schools, better test scores, and with fewer single parent families.”

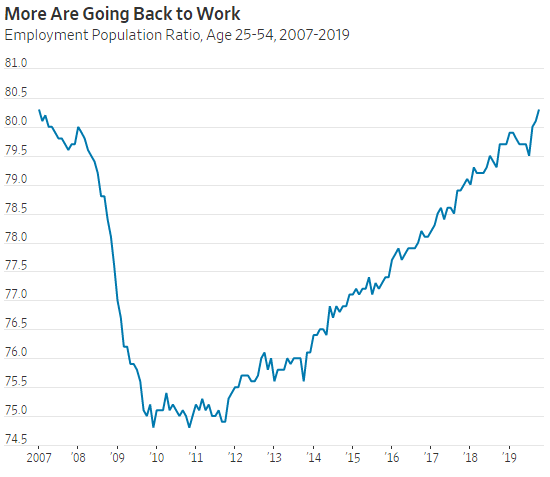

- Maintain full employment. “One of the best ways to create opportunity is full employment.” This, of course, is exactly what the Trump economy has accomplished.

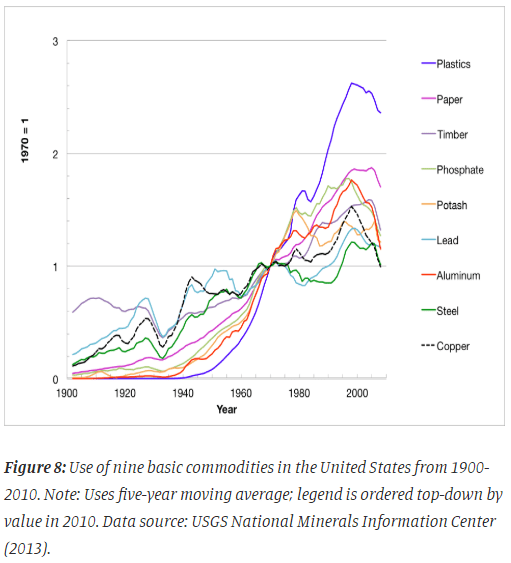

- High degree of market concentration. “One metric of the effects of high market concentration on innovation is the reduction in the number of startups.” Interestingly, another new book, “The Great Reversal: how America gave up on free markets” by the economic conservative Thomas Philipon, makes the very same case.

- The economic cycle. “We’re learning from evidence that broad prosperity for those on the bottom and middle rungs of the economic ladder not only reduce inequality but also can create better economic outcomes.” This is precisely what our currently generous government transfer programs and low unemployment rates are already accomplishing.

Conclusion. It would be much better to decrease income inequality by increasing market incomes of those on the bottom rather than doing it primarily with government transfer programs. Ms. Boushey has some good ideas for accomplishing this goal, several of which are already being implemented.