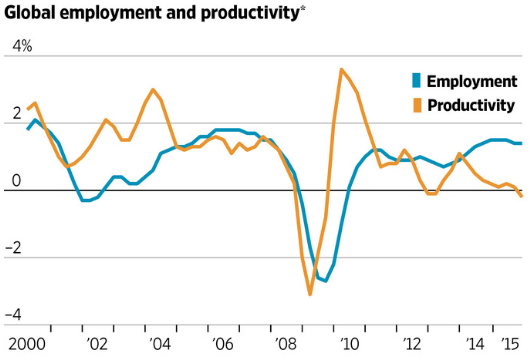

I have written several posts recently, here and here, about America’s current very slow rate of economic growth. In fact:

- From 1970 – 2000 our economy grew on average at the rate of 3.5%.

- Since 2000 it has grown at only half this rate, 1.76% annually.

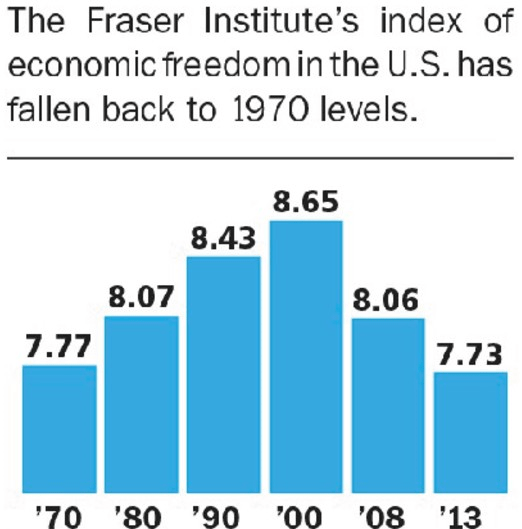

The economics journalist, Gene Epstein, writing in Barron’s, “The Real Reason Behind Slowing U.S. Growth,” points out the very strong correlation between our rate of GDP growth and the Fraser Institute’s Index of Economic Freedom in the U.S. This index is based on ratings in the five categories:

- Size of Government.

- Legal System and Security of Property Rights.

- Soundness of Money.

- Freedom to Trade Internationally.

- Regulation of Credit, Labor and Business.

As shown in the chart above, the biggest reductions have occurred in the (2nd) Legal System, (4th) International Trade and (5th) Regulation areas. Examples of freedom declines in the Legal System area are:

- Judicial Independence: political interference in the bankruptcy proceedings of GM and Chrysler.

- Impartial Courts: expanded use of Foreign Intelligence Surveillance Courts (FISA) where government requests are rubber stamped.

- Property Rights: eminent domain made easier by the Supreme Court’s Kelo vs City of New London decision in 2005. The expanded use of civil asset forfeiture.

- Military Interference in the Political Process: local police officers using excess military equipment.

According to the Fraser Institute, ”The effects of the Reagan and Thatcher political revolutions … led to increases in economic freedom and convergence among OECD nations. The so-called Washington Consensus of lower taxes, lower trade barriers, privatization and deregulation is quite evident in the data in the EF index. The last decade has not been as kind to the cause of economic freedom.”

Such a huge correlation between the rise and decline of economic freedom and the concurrent rise and decline of economic growth is unlikely to be a coincidence. Government policies strongly effect economic growth. To ignore this self-evident truth is to invite economic decline.