The Department of Commerce has just reported basic economic data for the second quarter of 2014. As the chart below shows, the economy gradually lost steam from 2004 – 2008, sunk badly in 2008 and 2009, and has now grown at a slow but steady rate of about 2% during the period 2010 – 2014.

One of my favorite journalists, the New York Times’ economics reporter Eduardo Porter, has just written again on the topic of inequality, “Income Inequality and the Ills behind It.” He quotes the economist Tyler Cowen as saying “The right moral question is ‘are poor people rising to a higher standard of living?’ Inequality itself is the wrong thing to look at. The real problem is slow growth.” The economist Gregory Mankiw is quoted as saying that “Policies which address the symptom (of inequality) rather than the cause include higher taxes and a more generous safety net. The magnitude of what we can plausibly do with these policy tools is small compared to the size of the growing income gap.”

One of my favorite journalists, the New York Times’ economics reporter Eduardo Porter, has just written again on the topic of inequality, “Income Inequality and the Ills behind It.” He quotes the economist Tyler Cowen as saying “The right moral question is ‘are poor people rising to a higher standard of living?’ Inequality itself is the wrong thing to look at. The real problem is slow growth.” The economist Gregory Mankiw is quoted as saying that “Policies which address the symptom (of inequality) rather than the cause include higher taxes and a more generous safety net. The magnitude of what we can plausibly do with these policy tools is small compared to the size of the growing income gap.”

What Mr. Cowen and Mr. Mankiw are both suggesting is that we can’t effectively attack income inequality without also increasing economic growth. I believe that it is possible to address both problems at the same time by implementing broad-based tax reform as follows:

- Individual income tax rates should be lowered across the board, paid for by closing loopholes and shrinking deductions, in a revenue neutral way.

- The 64% of all taxpayers who do not itemize deductions will get a significant tax cut. Since they are largely the middle and lower-income wage earners with stagnant incomes, they will tend to spend their tax savings, thereby giving the economy a big boost.

- At the same time the 36% of taxpayers who do itemize their deductions will, on average, see their income taxes go up. But these are, on the whole, the wealthier wage earners who can afford to pay higher taxes.

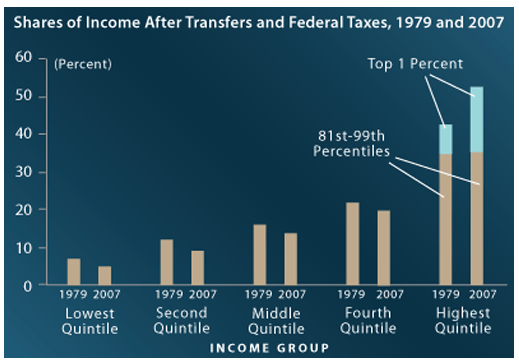

- A plan such as this represents a shift of net after-tax income from more wealthy people to the less wealthy. It therefore reduces income inequality.

If we can cut tax rates, increase economic growth and reduce income inequality all at once, why can’t our national leaders come together and act along these lines?