Here is the preliminary version of my campaign announcement, now scheduled for Wednesday, January 24, for the Nebraska Republican Primary for U.S. Senate:

“This may sound overly dramatic but if we ignore the debt much longer, it will endanger the future of our country.

This is exactly what the new tax law does, in spite of its otherwise good features, by increasing the debt by $1 trillion over the next decade. And 51 Republican Senators voted for this new law, including Nebraska’s Deb Fischer who is running for reelection this year. I am running for her seat to challenge her about our ballooning debt because she is doing nothing about it and has just voted to make it worse!

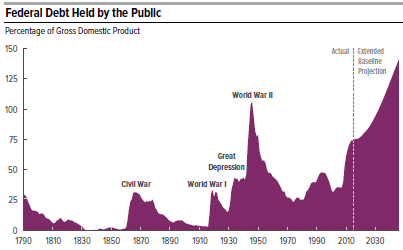

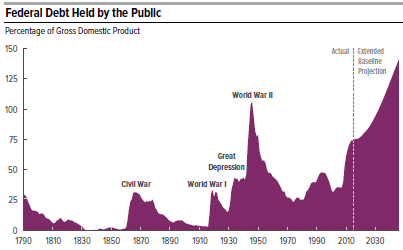

First of all, the chart below shows why our debt situation is so serious. It now sits at 77% of GDP (for the public part on which we pay interest), the highest since WWII, and is predicted by the Congressional Budget Office to keep getting steadily worse, hitting almost 100% of GDP by 2027.

Right now interest rates are so low, less than 2%, that our debt is almost “free” money. But this cannot and will not last much longer. Inflation has already started to increase and the Federal Reserve has started to raise interest rates.

Rising interest rates mean much higher interest payments on our debt. This will put an enormous strain on the federal budget, choking off spending for many of the things such as education, scientific and medical research, infrastructure and social programs which so enhance our quality of life.

And furthermore, these much higher interest payments on the debt will continue, and even grow worse, indefinitely into the future, placing a huge burden on future generations, our children and grandchildren.

The solution is to shrink our annual deficits ($668 billion in FY2017 and likely over $700 billion for 2018) down to a much more manageable level so that our debt will also shrink as a percentage of GDP.

I emphasize that this can be done in a sensible, non-disruptive way by simply curtailing spending increases in most government programs without actual budget cuts, and thereby reducing our huge annual deficits over a period of several years.

The Affordable Care Act expands access to healthcare (which is good!) but does nothing to control cost (which is bad!). American healthcare needs major changes. One way to do this is to abolish the employer mandate and migrate from employer provided health insurance to personal insurance with age-based, instead of income based, tax credits. Medicaid can move to the same age-based (refundable) tax credit system. Also fix Medicare by making Medical Savings Accounts readily available for Medicare Advantage plans and then encouraging migration from regular Medicare to Medicare Advantage.

Such major changes as I have proposed above likely will be considered controversial. However, which is better, to implement major changes in a rational, careful manner while there is time or rather to wait for a new fiscal crisis, much worse than the Financial Crisis of 2008, which will inevitably occur down the road if we continue to ignore the debt?

Summary. The U.S. has a horrendous debt problem which is getting worse all the time. We badly need representatives in Congress who will stop ignoring our debt and make reducing it a very top priority. This is why I am challenging Deb Fischer as she runs for reelection. “

Follow me on Twitter

Follow me on Facebook