President-elect Donald Trump is on record as favoring tax and regulatory reform in order to speed up economic growth and I have made it clear that this can be accomplished without increasing our debt.

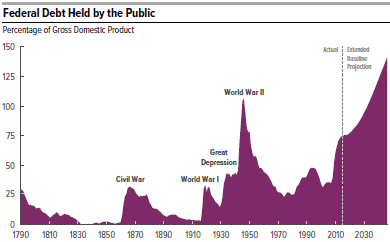

But what is really needed is to grow our economy faster and actually shrink our debt at the same time. It will be very difficult, essentially impossible, to accomplish this with growth alone or even by raising taxes because the magnitude of our debt, 76% of GDP and rising, is so great.

There is really only one way to begin to shrink the debt and this is to get entitlement spending under control. The above chart shows that, without major changes, by 2032 all tax revenue will go towards healthcare, Social Security and net interest. Here is what needs to be done:

- Social Security is already paying out $100 billion per year more than it collects in payroll taxes. Its Trust Fund will run dry in 15 years unless major changes are made and all benefits will drop by about 25% when this happens. We need to either increase the eligibility age for full benefits and/or raise the income cap on payroll taxes. These changes can be phased in but the sooner we get started the less painful it will be.

- Medicare is an even bigger problem than Social Security. Either we have government rationing, i.e. “death panels,” or else rationing by price meaning some form of premium support. This simply means that we will all have more “skin in the game,” in the sense that we will all have a financial incentive to minimize our own healthcare expenses.

- Medicaid should be block granted to the states so that the federal government is not obligated to a fixed match for all state Medicaid expenses. Again, cost control is the object of such a change.

Conclusion. It needs to be emphasized as strongly as possible that the reason for stringent cost control of entitlement programs is to preserve them for posterity, not destroy them. Our prosperous way of life is severely threatened by our unwillingness to recognize this problem.

Follow me on Twitter

Follow me on Facebook