We will soon have a new President and, even though his election was somewhat of a fluke, he will obviously want to help the blue-collar workers who elected him. The best way to do this is to make the economy grow faster.

The Gallup economist, Jonathan Rothwell, has just issued an excellent analysis of some of the major reasons for our current slow economy, “No Recovery: an analysis of long-term U.S. productivity decline.”

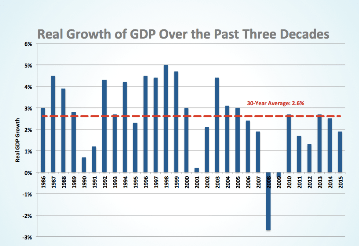

- The problem is severe. U.S. GDP growth per capita has declined from 2.6% in 1966 to .5% today. Small differences expand into vast gaps in potential living standards. 1% growth for the next 35 years would expand household income from $56,000 in 2015 to $79,000 in 2050 (inflation adjusted), whereas 1.7% growth would raise household income to $101,000 in 2050.

- Changes in living standards are fundamentally linked to changes of how the quantity of goods and services relate to their cost. Deterioration in the quality-to-cost ratio for healthcare, housing and education is dragging down economic growth. These three sectors alone have increased from 25% of GDP in 1980 to 36% of GDP in 2015.

- The cost of healthcare is 4.8 times as high today as in 1980, the cost of education is 8.9 times as high today as in 1980 and the cost of housing is 3.5 times as high today as in 1980. These compare to an overall cost increase of all items of 2.5 times today compared to 1980.

- These three sectors have all gotten more expensive (without getting more productive), thereby absorbing more of families’ incomes, making it harder to satisfy other wants.

Conclusion. We all want schools that work, adequate housing, and quality healthcare. The problem is how to achieve these ends in a much more affordable manner. Stay tuned!