Recently I have had several posts about our national debt, for example, “Why the National Debt Is Such a Threat to the U.S.,” showing graphically that our current public debt at 74% of GDP is very high by historical standards and rising rapidly under current fiscal policies.

Yesterday I attended a workshop in Washington D.C. put on by Fix the Debt. All expenses were paid and, in return, the attendees agree to make at least three presentations to local community groups during the following year. This means that I will soon be sending out a letter to such groups as Kiwanis and Rotary Clubs around the Omaha area where I live, offering my services as a speaker at one of their meetings. The purpose is to build more public awareness of the threat of a huge and growing national debt to the long-term welfare of our country. Here is a summary of talking points from the workshop:

Yesterday I attended a workshop in Washington D.C. put on by Fix the Debt. All expenses were paid and, in return, the attendees agree to make at least three presentations to local community groups during the following year. This means that I will soon be sending out a letter to such groups as Kiwanis and Rotary Clubs around the Omaha area where I live, offering my services as a speaker at one of their meetings. The purpose is to build more public awareness of the threat of a huge and growing national debt to the long-term welfare of our country. Here is a summary of talking points from the workshop:

- The deficit for the 2013-2014 fiscal year is almost $500 billion.

- Under current fiscal policies the debt will increase to 270% of GDP by 2080.

- Reasons for our debt problem:

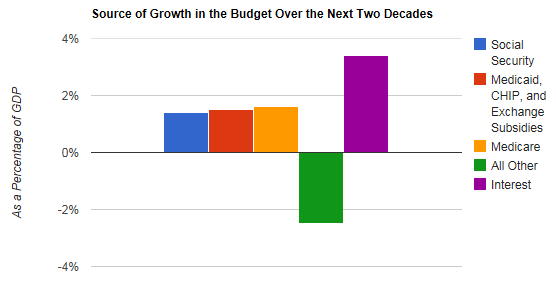

- An aging population which means expanded Social Security spending

- Healthcare costs are growing for both Medicare and Medicaid

- Interest costs will grow rapidly as the economy recovers and interest rates rise

- All bipartisan reform plans call for both spending cuts and revenue increases.

- The benefits of taking action are:

- Increased budget flexibility

- Lower exposure to changes in interest rates

- Reduced risk of another financial crisis

- The longer we wait:

- The older our population gets

- The higher the debt will rise

- The less time we have to phase in changes

- The slower our economy will grow

- The fewer tools we will have to fix it

- How do we bring debt under control?

- Enact policies that grow the economy

- Health care cost containment

- Spending cuts

- Tax reform and tax expenditure cuts

Let me know if you’d like a speaker on this topic at your club!