I am a candidate in the May 15 Nebraska Republican Primary for the U.S. Senate because the incumbent, Deb Fischer, is ignoring our enormous and out-of-control national debt. In fact she recently voted twice to make it worse.

The new tax law, in spite of its good individual features, increases our debt by $1 trillion over the next ten years, even after new growth is taken into account. The new budget agreement increases spending by hundreds of billions of dollars. Fischer voted for both of these measures.

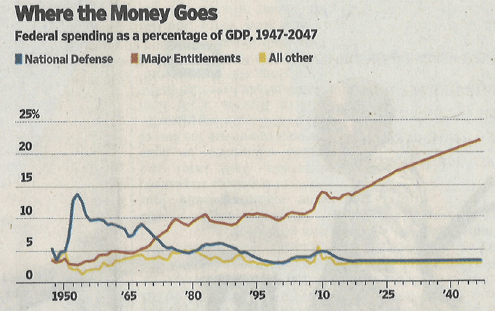

The Hoover Institution analyst, John Cogan, summarizes our dire fiscal situation in the above chart which compares three major categories of federal spending since 1950: defense, entitlements and all other. Entitlement spending is steadily increasing. The other two categories have stabilized at about 3.5% of GDP each.

The Hoover Institution analyst, John Cogan, summarizes our dire fiscal situation in the above chart which compares three major categories of federal spending since 1950: defense, entitlements and all other. Entitlement spending is steadily increasing. The other two categories have stabilized at about 3.5% of GDP each.

The Manhattan Institute scholar, Brian Riedl, explains why this situation is so serious that it is already an emergency:

- Between 2008 and 2030, 74 million baby boomers, will retire into Social Security and Medicare, at the rate of 10,000 per day.

- Today’s typical couple has paid $140,000 into Medicare and will receive $420,000 in benefits, largely because physician and drug benefits are not prefunded with payroll taxes (only hospitalization is). Social Security recipients also come out way ahead.

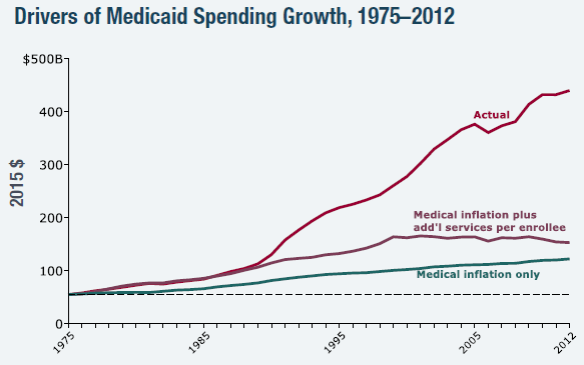

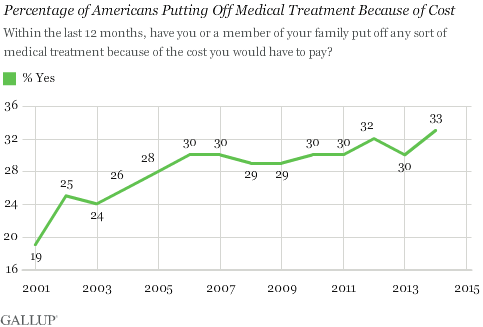

- The demographic challenge is much worsened by rising healthcare costs.

- The imbalance is so large that something has to give. Doubling the top tax rates of 35% and 37% to 70% and 74% (I.e. taxing the rich) would only cover 1/5 of the long term shortfall in revenue. An increase in inflation (purposeful or not) will not dilute away our debt. Social Security and Medicare benefits are also tied to inflation. Faster inflation would also increase interest rates and therefore interest payments on our rapidly growing debt.

- Restructuring cannot wait. Every year of delay sees 4 million more baby boomers retire and get locked into benefits which will be difficult to alter. “Reality will soon fall like an anvil on Generation X and Millennials as they find themselves on the wrong side of the largest generational wealth transfer in world history.”

Conclusion. A severe form of fiscal cancer is gradually creeping over the body politic. We ignore it at our grave peril.