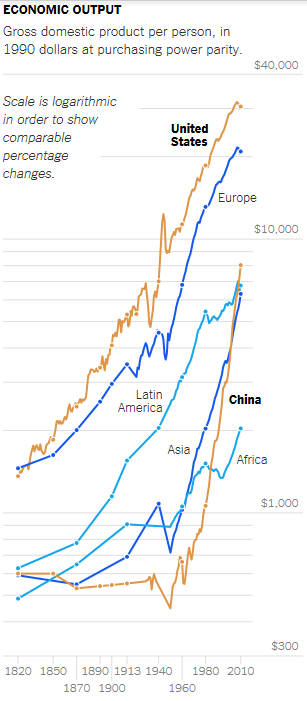

The U.S. economy has only been growing at the rate of 2.1% since the end of the Great Recession in June 2009, almost seven years ago. Such a slow rate of growth means millions of unemployed and underemployed workers and only small salary raises for tens of millions of others.

The New York Times economic journalist, Eduardo Porter, observes that we have “A Growth Rate Weighted Down by Inaction.” He points out that:

The New York Times economic journalist, Eduardo Porter, observes that we have “A Growth Rate Weighted Down by Inaction.” He points out that:

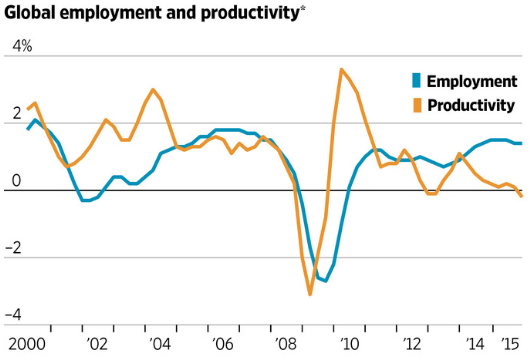

- Our economy is adversely affected by the gradual shrinkage of the work force as a share of population as baby boomers retire and the one time surge of women into the workforce in the 20th century has ended.

- A second factor is a persistent decline in productivity growth over the last dozen years.

- A pessimistic forecast by the Economic Cycle Research Institute foresees growth of only 1% per year for the next five years. The Congressional Budget Office projects more optimistic productivity growth at 1.5% per year, which added to workforce growth of .5% per year, would amount to total growth of 2% per year for the next ten years.

Mr. Porter goes on to say that there are concrete reasons why productivity growth is so slow:

- Hiring is growing faster than capital investment. This is because most job growth in the last decade has been in (low productivity) services instead of (high productivity) manufacturing.

- Too many restrictions on educated immigrants. Relaxing these restrictions would increase entrepreneurship.

- Too many onerous regulations.

- Under training of skilled workers. We need more vocational and career education.

Many people, including myself, have pointed out ways to alleviate these problems and speed up economic growth, for example see here. It is most unfortunate that our dysfunctional national leadership cannot figure out how to work together to get this done.