I have tried to make it clear in my post that I have not endorsed either of the two main presidential candidates. In fact I am waiting to see a credible plan for simultaneously spurring economic growth and getting our very large and growing national debt under much better control.

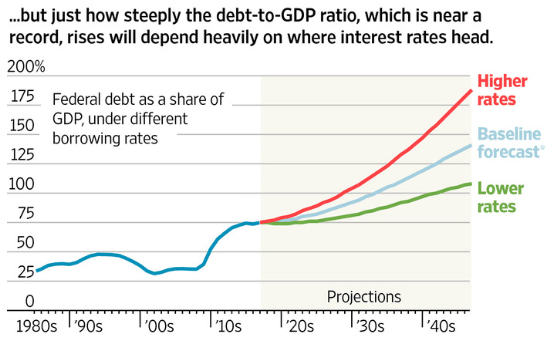

The debt problem is real and cannot be sloughed off as many try to do. The two charts below show that while annual deficit levels have returned to what may be considered “normal” since 1984, they are still much too high and will lead to a rapidly increasing level of debt even if interest rates remain low which is by no means assured.

In other words, it is not good enough to just make the economy grow faster, it needs to be done in a fiscally responsible way.

I’ve already discussed how the Trump tax plan is unacceptable because it will substantially raise deficits and therefore make the debt much worse.

The same thing is true for the Clinton plan for “equitable” growth, but in a different way. She wants

- $250 billion in new spending for infrastructure.

- Free public college tuition.

- Universal Pre-K education.

Regardless of their individual attractiveness, it is irresponsible to propose new programs, with new spending, when deficits are already way too high and the debt is steadily climbing.

She also wants to:

- Raise the national minimum wage to $15 per hour.

- Mandate paid family leave.

The problem here is that both of these measures will increase unemployment and therefore slow down economic growth. Many states and cities are raising the minimum wage on their own and this way is preferable because it is locally determined. Paid family leave should be left up to individual employers to use as an incentive to attract and retain good employees.

Conclusion. Hillary Clinton does want to make the economy grow faster which is highly desirable. But she would do it with new federal spending and new mandates. The new mandates will actually slow growth. The new spending programs will add to the debt. Both approaches are counterproductive.