Is it possible for the U.S. to effectively address its enormous debt problem in today’s contentious political environment? Two weeks ago I discussed in “America’s Fourth Revolution” why the political scientist James Piereson thinks this is impossible. He is very persuasive but I think he is too pessimistic.

Since then I have discussed several different things we should do to turn around this perilous situation:

Since then I have discussed several different things we should do to turn around this perilous situation:

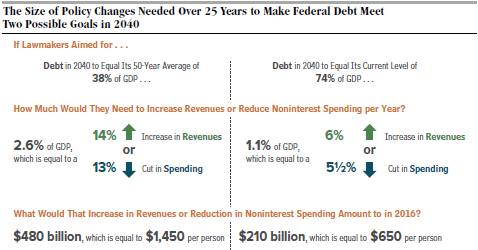

- If spending for just Medicare and Medicaid (two very expensive entitlement programs) alone fell by 25% over ten years, as a percentage of GDP, and then stayed in line with GDP after that, the U.S. would actually have a budget surplus in 2040.

- Just recognizing the magnitude of our debt problem would do wonders in public awareness.

- If the Tea Party were able to grow beyond a protest movement and unite the country behind a majoritarian agenda of work, mobility and opportunity, it would be much more effective in achieving its fiscally conservative goals.

- Another significant way to save money, and get better results at the same time, is to turn over more and more programs to the states. A good way to do this is with block grants to the states for federal programs in such areas as welfare, education and Medicaid. This would give the states more flexibility to get the job done in an efficient and cost saving manner.

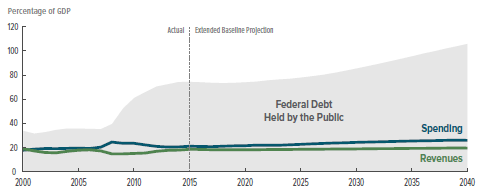

What we need to do to turn our debt situation around is to greatly shrink our annual deficits below their current level of about $450 billion per year. If the debt is growing slower than the economy, then it will shrink as a proportion of the economy. This is what happened after WWII (see above chart) and it needs to happen again now!

Here is a good example of this refusal to take the debt seriously. The advocacy group FAIR (Fairness and Accuracy in Reporting) ridicules NPR for addressing this problem, “

Here is a good example of this refusal to take the debt seriously. The advocacy group FAIR (Fairness and Accuracy in Reporting) ridicules NPR for addressing this problem, “