It is now almost certain that Hillary Clinton will be the Democratic nominee for President and that Donald Trump will be the Republican nominee. The two biggest problems facing our country today are:

- Slow economic growth, averaging just 2.1% since the end of the recession in June 2009, seven years ago. Even though unemployment is down to 5%, stagnant wages for the middle class have not nearly recovered from their pre-recession high.

- Massive debt. The public debt (on which we pay interest) is now at 74% of GDP and rising. When interest rates go up, as they surely will eventually, debt payment will rise by hundreds of billions of dollars per year and be a huge drain on government revenues.

The likely Presidential nominees are not adequately addressing these problems:

- Hillary Clinton wants to increase government spending by about $100 billion per year to be spent on various new programs and raise the top tax rate to 45% to pay for them. This will do nothing to either grow the economy faster or shrink our already sizable deficit.

- Donald Trump has promised to keep entitlements as they are and spend more on infrastructure and defense. He also sees debt as useful. “I probably understand debt better than anybody” he has stated. His tax plan (which he says is negotiable) will create massive new debt.

If Clinton is elected, she may pull the Senate Democratic along with her. But either way the House of Representatives will likely remain Republican with Speaker Paul Ryan.

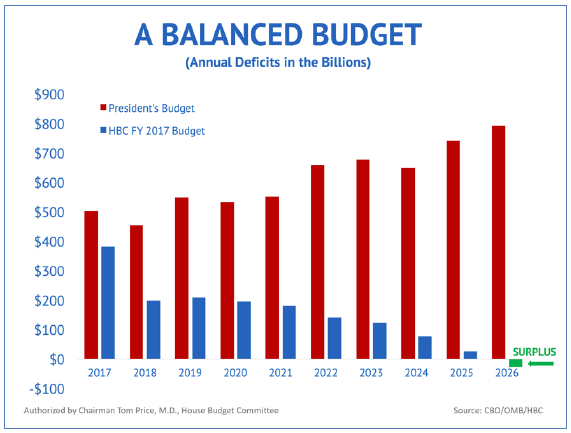

Since the Republicans took over the House in 2010, they have consistently proposed budgets each year to shrink the deficit and produced a balanced budget within ten years. The new President, either Clinton or Trump, will have to negotiate their own ideas on spending and taxes with a fiscally conservative House.

Since the Republicans took over the House in 2010, they have consistently proposed budgets each year to shrink the deficit and produced a balanced budget within ten years. The new President, either Clinton or Trump, will have to negotiate their own ideas on spending and taxes with a fiscally conservative House.

The country is indeed very fortunate for this circumstance.

Follow me on Twitter

Follow me on Facebook