“I think this level of national debt is dangerous and unacceptable. My preference on tax reform is that it be revenue neutral. What I’m hoping we will avoid is a trillion dollar stimulus. Take you back to 2009. We borrowed $1 trillion and nobody could find that it did much of anything. So we need to do this carefully and correctly, and the issue of how to pay for it needs to be dealt with responsibly”

Senator Mitch McConnell (R, KY), 2016

Here is where we are today:

- The world has seen remarkable human progress over the past 200 years. What has brought this about is specialization and trade, i.e. economic growth.

- Since the end of the Great Recession in June 2009, economic growth in the U.S. has averaged just 2.1%, a remarkably slow recovery by historical standards. This has led to stagnant wage growth especially for blue collar workers. Finally growth is up over 3% for the past two quarters and wage growth is surging.

- The U.S. corporate tax rate at 35% is not internationally competitive and encourages multinational corporations to move their operations overseas. A lower rate of 20% or so would encourage U.S. multinationals to bring their profits home and also encourage foreign companies to set up shop in the U.S.

- What all of this means is that we still need tax reform (i.e. lower tax rates) but not fiscal stimulus.

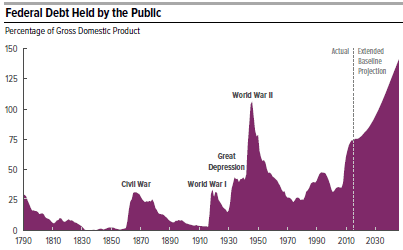

- The Republican tax plan now moving through Congress will increase our already outrageously excessive debt by $1 trillion over ten years, according to the Joint Committee on Taxation, the official scorekeeper for the U.S. Senate.

- The Republican Congress will be making a huge mistake by implementing the current plan which has now passed both the House and the Senate. The GOP will no longer be able to make a credible case that it is the party of fiscal responsibility.

Conclusion. With a (public, on which we pay interest) debt of $15 trillion, and growing rapidly, the U.S. is approaching fiscal insolvency. The Republican tax plan will add an additional $1 trillion to this debt over the next ten years. This is unconscionable behavior.

Follow me on Twitter

Follow me on Facebook