I want to be as clear as possible that I have not yet endorsed either Hillary Clinton or Donald Trump for President and I am not doing so now. Each of them has strengths and weaknesses which I am still weighing:

- Mrs. Clinton has extensive experience and a steady temperament but her policy prescriptions are unlikely to lead to the faster economic growth needed to boost prosperity.

- Mr. Trump lacks government experience and has a volatile temperament. However many of his policy proposals make very good sense.

Pre-debate expectations were very low for Mr. Trump, based on his assumed lack of familiarity with many important issues. Nevertheless he showed that he does have a solid understanding of both national and international affairs. On the three general debate topics:

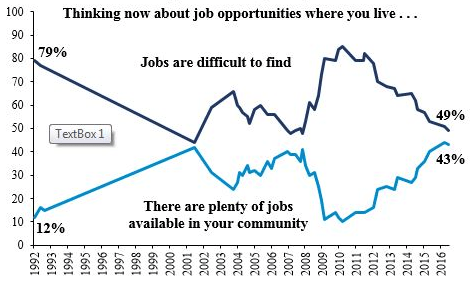

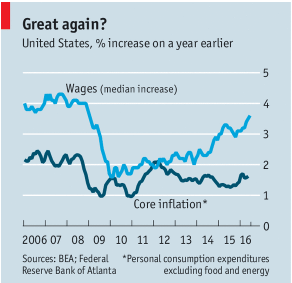

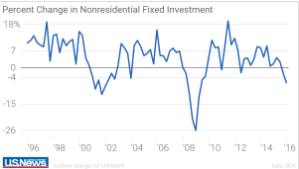

- Achieving Prosperity. Mr. Trump was very clear in stating what needs to be done to create more jobs and better paying jobs. He advocates individual tax reform to stimulate more business investment as well as corporate tax reform to encourage multinational companies to bring their foreign earnings back home for reinvestment.

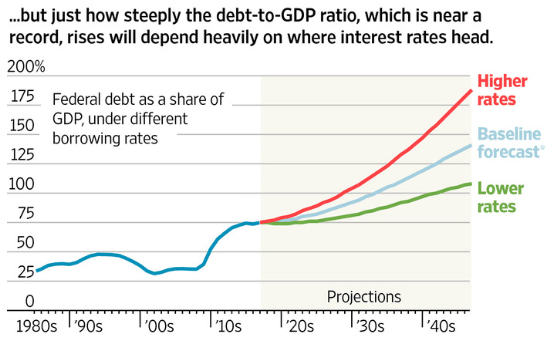

- America’s Direction. Mr. Trump made several references to our massive national debt of $20 trillion even though he didn’t say what he’ll do about it. He also stated very strongly that he is opposed to the Trans-Pacific Partnership and the North American Free Trade Agreement as well. Let’s hope that Mr. Trump’s bluster is just a ploy to improve his bargaining position with other countries. Otherwise he could set off a major new recession.

- Securing America. Mr. Trump is very clear on the need to destroy ISIS and to do so as quickly as possible. He believes that our 27 NATO allies should be contributing more towards our mutual defense. He also supports “stop and frisk” police policy as the best way to cut down on crime and violence in our inner cities.

Conclusion. Mr. Trump’s clearly stated views on these major national issues in last night’s debate were very impressive. By establishing so well his qualifications to be president, he won the debate.

Follow me on Twitter

Follow me on Facebook