Last week, both the House and the Senate passed ten year budget plans which would bring the federal budget into balance by 2025. I have devoted several recent blog posts to discussing these budget proposals and how they address our very serious debt and deficit problems.

There are several important points to make:

There are several important points to make:

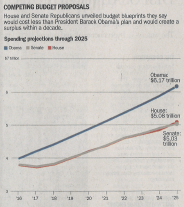

- Under both of these Republican plans, overall spending will continue to increase by an average of 3.3% per year, from $3.8 trillion in 2016 to just over $5 trillion in 2015. The President’s budget would increase spending to $6.17 trillion by 2025 and would achieve no balance between spending and revenue.

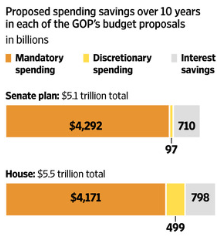

- Most of the savings in the Republican budgets, as indicated in the above chart, come from the mandatory (entitlement) programs of Social Security, Medicare and Medicaid. Medicare would be transformed into a subsidy program along the lines of the exchanges set up under the Affordable Care Act. Medicaid would be turned into a block grant program administered by the states. Social Security would be studied by a bipartisan commission to recommend operating efficiencies.

- Other social welfare programs would be affected to a much smaller extent. For example, the Supplemental Nutrition Assistance Program (SNAP), or Food Stamps, has seen a growth of recipients of 69% between 2008 and 2013 while the poverty rate increased by just 16.5% during the same period. The Republican budgets would block grant Food Stamps to the states in order to achieve operating efficiencies.

- It is true that both the House and Senate budgets would increase military spending by about 10%. But so would the President’s budget and we live in a very dangerous world. Military defense is one of the most very basic functions of our federal government.

Our country is in dire fiscal condition with large annual deficits projected indefinitely into the future, contributing to an exploding national debt. It is heartening that our political system is responding to this threat to our future security and prosperity. Let’s hope that House and Senate majorities continue to keep a sharp focus on the urgent task of fiscal restraint.