President Trump has proposed spending $1 trillion over the next decade on public and private investment in infrastructure. The CATO Institute’s Ryan Bourne has just published an excellent analysis of the whole issue. Here are the highlights:

- Any new federal spending must take into account that federal public debt now stands at 77% of GDP and is likely to keep rising given the demographic pressures on entitlement spending. This means that the long-term outlook for public finances is dire.

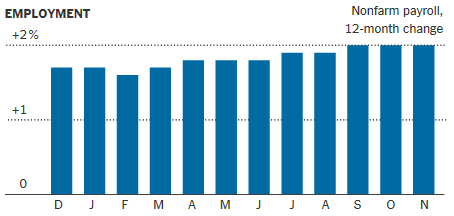

- With a current low unemployment rate of 4.4% and a high of 6 million job openings, the economy does not need more government stimulus at the present time.

- Bridge quality has improved substantially since 1990 (see chart) although roadway congestion has become more acute (second chart). Rail and transit systems appear to be the main areas with observable deterioration.

- The difference between state highways (which are in good condition), local roads (which are in fair condition) and transit systems (which are in poor condition) is simple: state road maintenance is paid almost entirely out of user fees (gasoline taxes), local road maintenance is paid for by a combination of taxes and user fees (motor vehicle registrations and parking meters) while transit maintenance is paid for almost entirely out of taxes.

The above indicates that the following policy framework should be followed:

- Privatize areas where government is not needed such as airports, air traffic control systems and railways (Amtrak).

- Localize decision making as far as possible such as decentralizing responsibility for transportation infrastructure back to the states.

- Remove payment barriers for charging users. This could reduce the cost of capital investment required for highway systems by 30%.

- Level the playing field for private sector funding. Currently interest income received for investing in municipal bonds is tax free which is not the case for private debt.

Conclusion. “Rather than imposing further costs on taxpayers, the Trump Administration should prioritize localizing decision making, removing regulatory barriers to private investment, encouraging use of user fees and removing tax exemptions for public investment.”

The New York Times predicts that the “

The New York Times predicts that the “