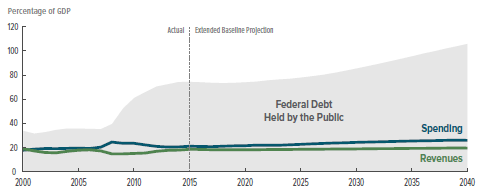

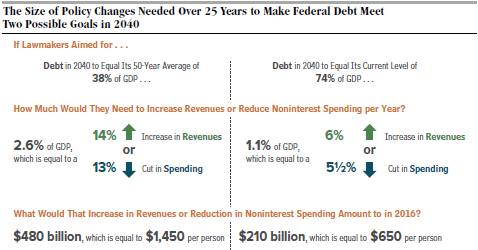

My last blog post, “Could the U.S. End Up Like Greece?” compares Greece’s present fiscal situation (public debt at 180% of GDP) with our own current fiscal situation (public debt at 74% of GDP and rising fast). The Congressional Budget Office predicts that, under current policy, the U.S. debt will not reach 180% until about 2055, forty years from now. One could (wrongly!) conclude from this that we are okay for the time being.

However, this is not true! The Peter G. Peterson Foundation has taken a closer look at the most recent CBO report. Under a less optimistic, but more realistic, Alternative Fiscal Scenario, the U.S. debt will reach 175% in 2040. The Alternative Fiscal Scenario assumes, for example, that:

However, this is not true! The Peter G. Peterson Foundation has taken a closer look at the most recent CBO report. Under a less optimistic, but more realistic, Alternative Fiscal Scenario, the U.S. debt will reach 175% in 2040. The Alternative Fiscal Scenario assumes, for example, that:

- About 50 expiring tax breaks will continue to be extended year by year, as they were in 2014 and have been repeatedly in the past. These “tax extenders” increase the deficit by over $40 billion per year.

- Discretionary spending will soon rise back up to its historical share of GDP. In other words, the sequester, which is currently holding down the growth of discretionary spending, may be overridden or at least relaxed.

Greece, with its debt at 180% of GDP, is only being required by the European Central Bank to pay 1.7% interest on this debt indefinitely into the future. Thanks to the low interest rate policy of the Federal Reserve, 1.7% is also the current rate of interest being paid on the U.S. debt. But this historically low interest rate is unlikely to continue much longer without setting off a much higher rate of inflation.

In other words, we’ll likely be in the same situation as Greece is currently, in much less than 25 years. Furthermore, Germany and the other EU countries have been keeping Greece afloat for years and may continue to do so.

Who is going to bail us out when we get to where Greece is now? China? Unlikely. We’ll be on our own and it won’t be pretty!

Here is a good example of this refusal to take the debt seriously. The advocacy group FAIR (Fairness and Accuracy in Reporting) ridicules NPR for addressing this problem, “

Here is a good example of this refusal to take the debt seriously. The advocacy group FAIR (Fairness and Accuracy in Reporting) ridicules NPR for addressing this problem, “