A Letter from Birmingham Jail Why we cannot wait Martin Luther King, Jr., April 16, 1963

Yesterday was Martin Luther King Day and every year at this time we are reminded of his eloquent letter from the Birmingham Jail, “Why we cannot wait,” written to some of his hesitant supporters in the Spring of 1963.

African-Americans were tired of waiting so long for equal rights in their own country. On my own personal scale, I am so frustrated by the inability of our political system to address our massive debt problem, that I am getting organized to enter the 2018 Nebraska Republican Senate Primary against the incumbent Deb Fischer who has just voted (with the new tax law) to increase our debt by $1 trillion over the next decade.

Basically I am saying that our debt is so large and growing so fast that it will soon be out of control if we don’t take action to start reducing it very soon.

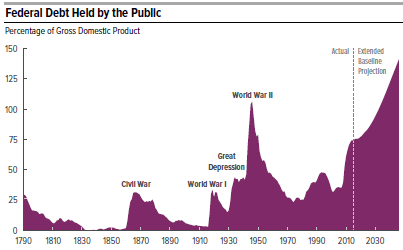

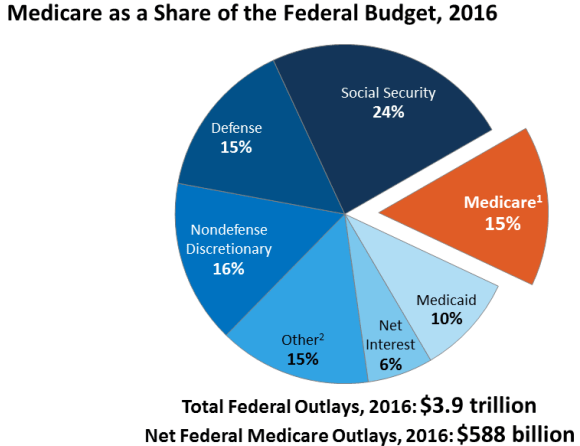

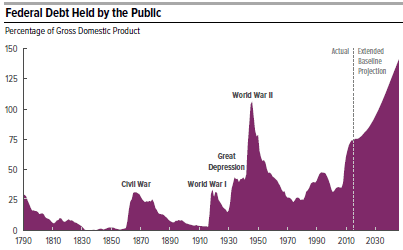

- The public debt (on which we pay interest) is now 77% of GDP, the highest since WWII, and projected by the Congressional Budget Office to keep getting steadily worse. It will grow by $11.5 trillion in just 10 years to almost 100% of GDP and will reach 150% of GDP, double the current level, by 2047, without major changes in current policy.

- A fiscal crisis, much worse than the Financial Crisis of 2008, will occur long before 2047 if nothing is done to greatly shrink our annual deficits which are again rapidly approaching the trillion dollar per year level.

- The new tax law increases deficits by an average of $100 billion per year, and therefore makes it that much harder to shrink them down substantially. It is imperative for the two parties, Democrats and Republicans, to work together to figure out how to do this.

Conclusion. Our national debt is so large and growing so fast that it is virtually out of control. We need prompt and fairly strong action to turn the situation around. I have often discussed one major way to do this.