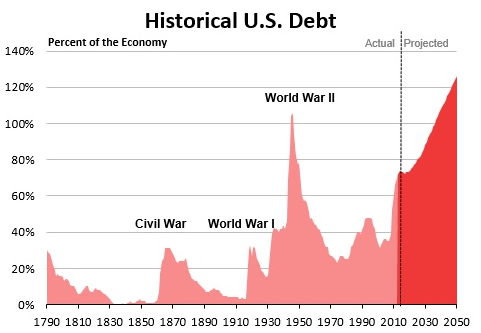

My last post, ”Fixing the Debt: Creating a Greater Sense of Urgency,” expresses my dismay that our huge debt problem does not receive enough serious attention from the American people. Yes, most Americans deplore the national debt and the deficit spending that leads to it, but it only too seldom affects how they vote for candidates for federal office, thus giving a pass to the big spenders in Congress.

Here is a good example of this refusal to take the debt seriously. The advocacy group FAIR (Fairness and Accuracy in Reporting) ridicules NPR for addressing this problem, “Look a Deficit: How NPR Distracts You From Issues That Will Actually Affect Your Life.” Here is what FAIR is saying:

Here is a good example of this refusal to take the debt seriously. The advocacy group FAIR (Fairness and Accuracy in Reporting) ridicules NPR for addressing this problem, “Look a Deficit: How NPR Distracts You From Issues That Will Actually Affect Your Life.” Here is what FAIR is saying:

- Interest on the national debt is projected to be only 2% of GDP in 2016 and 3% of GDP in 2024, which is tiny. (But this is because the interest rate for the debt is now abnormally low, approximately 1.7%).

- If the Fed keeps interest rates low, then interest on the debt will continue to stay low indefinitely and so the debt will continue to be a trivial problem. And the President appoints 7 of the 12 voting members of the Fed Open Market Committee which sets interest rates.

- The reason the Fed raises interest rates is to slow the economy and keep people from getting jobs. (Actually the real reason is not to keep people from getting jobs but to keep inflation under control. Once inflation takes off, it is very difficult to bring it back down as we painfully discovered in the late 70s and early 80s).

- Anyhow, if the Fed raises interest rates to keep the labor market from tightening, as it did in the late 1990s, this would effectively be depriving workers of the 1.0 – 1.5 percentage points in real wage growth they could expect if they were getting their share of productivity growth. (A rise in interest rates need not choke off economic growth which is primarily affected by supply and demand. Fiscal policy (tax rates and spending), established by Congress, has a far greater effect on the rate of economic growth than does monetary policy).

If our debt is not soon placed on a sustainable downward path, we will soon have another financial crisis, much worse than the Great Recession of 2008. This will affect everyone’s life in a substantial and very unpleasant way.