The U.S. economy is in a peculiar and potentially perilous situation:

- On the one hand, overall economic growth has averaged only 2.1% since the end of the Great Recession in June 2009.

- On the other hand, the unemployment rate has dropped from 8% in early 2012 to 5% today.

- But wages and salaries have grown by only 2% in the past year and near that rate for the past four years.

What explains our relatively low, and steadily dropping, unemployment rate when overall economic growth, and wage growth in particular, are so slow?

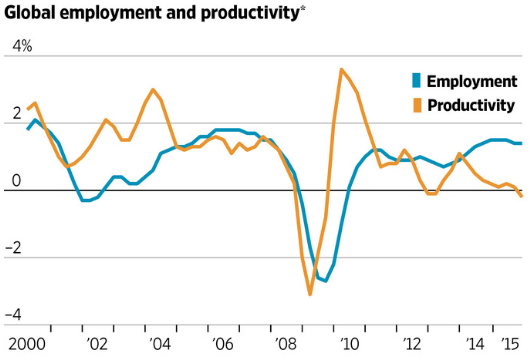

It is low productivity growth as the New York Times’ Neil Irwin, has recently pointed out: here and here.

It is low productivity growth as the New York Times’ Neil Irwin, has recently pointed out: here and here.

- GDP is up 1.9% in the past year. But the number of hours worked by Americans is also up 1.9% in the past year. This means no increase in labor productivity in the past year.

- For the past five years labor productivity has only advanced by .4% annually, far below the 2.3% average annual growth since the 1950s.

- Most job growth in the last decade has been in (low productivity) services rather than (high productivity) manufacturing.

We do not have to accept low productivity growth as immutable. As I have recently discussed here, and here, better government policies can boost labor productivity and therefore boost economic growth as well. Here is a brief summary of what needs to be done:

- Decrease regulation: the Dodd-Frank Act and Affordable Care Act, for example, are hampering growth by increasing the inefficiency of the financial and healthcare sectors of the economy.

- Reform taxation: growth oriented taxation would have the lowest possible rates paid for by shrinking deductions.

- Reform immigration: giving legal status to millions of illegal immigrants would turn them into far more productive citizens.

In other words, our severe slow growth predicament can be greatly ameliorated if we would adopt more sensible economic policies. It is a shame that this is so hard to do!