My last three posts have discussed the long term damage that will be caused by excessive spending in the recently passed 2016 federal budget and what should be done about it.

There is at least one way to force Congress to act in a responsible manner, namely, by putting into effect a Balanced Budget Amendment to the Constitution. Here is a brief history of recent efforts to do exactly this:

There is at least one way to force Congress to act in a responsible manner, namely, by putting into effect a Balanced Budget Amendment to the Constitution. Here is a brief history of recent efforts to do exactly this:

- In the 1995-96 session of Congress, the House of Representatives passed (by a 2/3 vote) a BBA but it was defeated in the Senate by one vote.

- Application by 34 states requires Congress to call a Constitutional Convention to propose an amendment. At the end of 2009, 16 states had so applied. Each year since one or more new states have also applied and now there are a total of 27. An additional 13 states are actively considering applications for a BBA at the present time.

- As the number of applying states gets close to the required 34, it becomes more and more likely that Congress will act on its own in order to preempt a “Con-Con.” This would avoid the messiness and uncertainties of such a convention, none of which have yet occurred in our nation’s history.

- Once 34 states have applied, however, Congress must call a convention. Any fear of a runaway convention, exceeding a limited mission, should be alleviated by the fact that any proposed amendment(s) have to be ratified by 38 states.

- In my opinion a proposed amendment should have no restrictions on how a balanced budget will be obtained. There will be far more political pressure to cut spending than to raise taxes. Let Congress hash out the proportion of each.

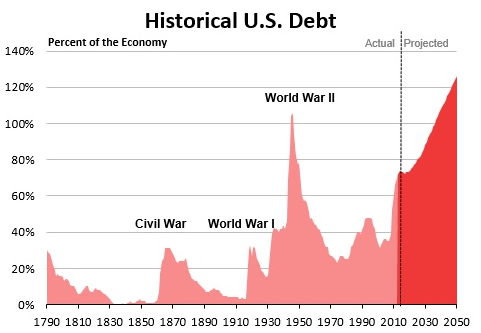

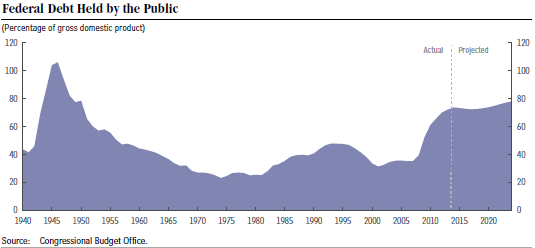

Fiscal responsibility does not require the budget to be exactly balanced each year. In fact, temporary deficits can be useful as a stimulus in time of recession. However, deficit spending has gotten so far out of control in recent years that Congress must be forced to modify its behavior.

Follow me on Twitter: https://twitter.com/jack_heidel

Follow me on Facebook: https://www.facebook.com/jack.heidel.3