With the presidential election tightening and Hillary Clinton still the favorite to win, more and more attention is being devoted to trying to figure out what will happen to the GOP after Donald Trump. William Galston from the Brookings Institute sees a three-headed Republican party:

- Wall Street i.e. establishment (fiscal) conservatives.

- Main Street i.e. small government conservatives who think that government is the main obstacle to growth.

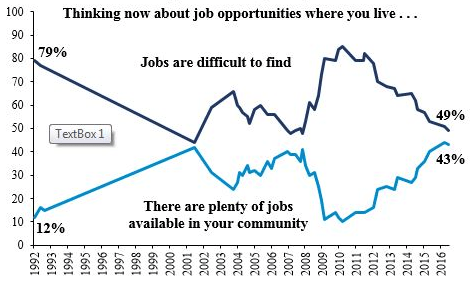

- Populists i.e. non-ideological working class people who feel left behind by the modern world.

The Wall Street Journal is analyzing the Trump phenomenon with a series of articles, “The Great Unraveling” based on an underperforming U.S. economy:

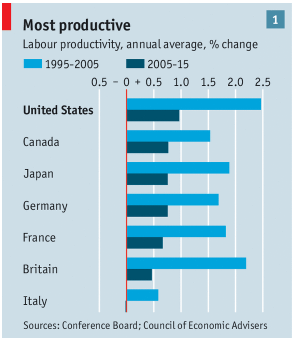

- Technology has not led to broadly shared prosperity.

- The Federal Reserve did not foresee the financial crisis and hasn’t delivered adequate growth.

- Trade with China has put millions of Americans out of work.

Today’s WSJ, “Republicans Rode Waves of Populism until They Crashed the Party,” describes the transformation of the Republican party all the way from Richard Nixon’s southern strategy, Pat Buchanan’s anti-immigration appeal in 1992, the Tea Party uprising in 2009 and 2010 until today’s populist rebellion against the establishment.

The map above shows the huge political realignment which has taken shape between 1996 and 2012 and is undoubtedly even more pronounced in 2016. The main question for me is whether and to what extent the three main Republican factions can come together on important policy issues such as immigration and trade:

The map above shows the huge political realignment which has taken shape between 1996 and 2012 and is undoubtedly even more pronounced in 2016. The main question for me is whether and to what extent the three main Republican factions can come together on important policy issues such as immigration and trade:

- Immigration. In the last debate Mr. Trump said that after the border is secured, and the “bad guys” are deported, then we’ll figure out what to do with the rest of the undocumented immigrants. This suggests a workable approach to the illegal immigration problem.

- Trade. The challenge is to figure out how to make the proposed Trans Pacific Partnership trade agreement compatible with the interests of working Americans.

Conclusion. Regardless of the outcome of the November 8th election, Donald Trump has had a huge effect on American politics. Whichever party is most successful in appealing to the core working-class Trump voters will have a huge advantage in the 2020 elections.

Follow me on Twitter

Follow me on Facebook