Trumponomics is taking shape: tax reform, regulatory reform and infrastructure spending. The likelihood of President-elect Donald Trump and Congress working together on these major initiatives is so great that the dollar and the U.S. stock market are surging. This complicates the Trump trade agenda:

- The yuan is now being driven down against the dollar. China will face even more pressure to devalue in the year ahead as the U.S. Federal Reserve raises interest rates and the dollar continues to strengthen. Stronger U.S. growth will also increase the demand for Chinese goods, making our trade deficit with China even greater.

- One way to increase U.S. manufacturing employment is to figure out how to train workers for the 334,000 manufacturing jobs which are now vacant. Wages are stagnant is America today not because we have too few taxes and restrictions on international trade but because we have too many taxes and restrictions on domestic trade here at home.

- When the U.S. entered the North American Free Trade Agreement, Mexican taxes on U.S. imports fell from 12.5% to zero, Canadian taxes fell from 4.2% to zero and U.S. taxes on Mexican and Canadian imports fell from 2.7% to zero. In other words, NAFTA improved America’s competitive position.

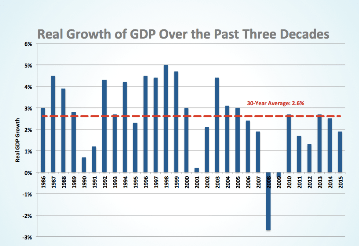

- Pro-growth economic policies are the key to higher wages. From 1900 to 2000 employment in agriculture declined from 41% of the workforce to 1.9%. But the number of jobs in the country rose fivefold and average real income rose eightfold. All because of pro-growth economic policy. The same thing can happen again with respect to manufacturing employment in the 21st century.

- Eliminating direct currency manipulation and special interest provisions in existing trade agreements will benefit American workers, raise world living standards and reinforce the impact of Mr. Trump’s primary recovery program.

Conclusion. Restricting international trade won’t bring back high-paying manufacturing jobs. But faster overall economic growth will create more jobs and better paying jobs as businesses have to compete more vigorously for qualified employees.

Follow me on Twitter

Follow me on Facebook