Income inequality in the U.S. is a major problem, getting worse all the time. There are many reasons why this is happening and many suggestions for how to deal with it. On the other hand, it is well appreciated that a college degree is one of the best tickets for upward mobility into the middle class. A new book by Suzanne Mettler, “Degrees of Inequality,” shows how American higher education is actually increasing the divide between the haves and have-nots. She points out that:

- There are too few college graduates in the U.S. In 2010 Americans between ages 25 and 34 had a college graduation rate of 33%. At least 10 OECD nations have higher rates (see below). American world leadership in the future will be jeopardized if we don’t continue to be an educational leader as we have been in the past.

- America is graduating inequality. College degree attainment has increased between 1970 and 2011 for all income groups. However this is happening much more quickly for higher income groups. 83% of 18 to 24 year olds now have a high school diploma and 75% of this group start college. But the completion rate by age 24 is only 47%, mostly from the higher income groups (see below).

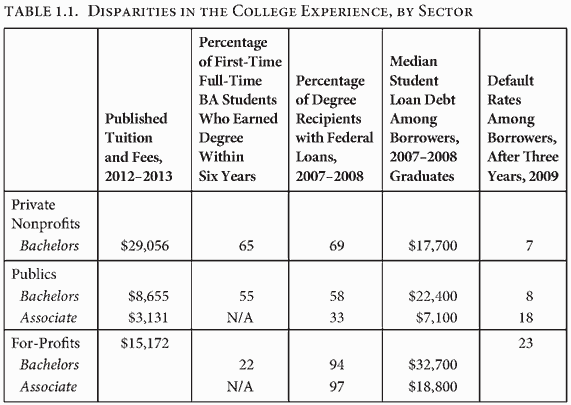

- Not all college degrees are created equal. Students at private, nonprofit institutions graduate at higher rates than students from public institutions who, in turn, graduate at much higher rates than students from for-profit institutions. And graduates of the for-profits have larger loan debt than for graduates from private nonprofit and public institutions.

Students at for-profit educational institutions tend to be from lower-income families. As noted, they have lower graduation rates and end up with higher debt levels. Clearly the three tier system of American higher education has a harmful effect on the young adults who need the most help in moving up the economic ladder.

How should society address this major problem in an era of tight public spending? One answer is to increase regulation of the government-run student loan program. All educational institutions should be held at least partially responsible for the defaulted loans of their former students.

Another approach is to increase financial support for community colleges so that they can provide more programs for the low-income students who are most likely to attend them.