As I often remind the readers of this blog, the two main topics are what I consider to be America’s two biggest economic and fiscal problems:

- Slow economic growth, averaging just 2% since the end of the Great Recession in June 2009. This means fewer new jobs and smaller raises.

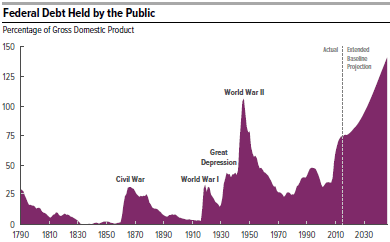

- Massive debt, now 77% of GDP for the public part on which we pay interest, the largest since the end of WWII and predicted by the CBO to keep getting worse. As interest rates rise from their currently unusually low levels, interest payments on the debt will skyrocket.

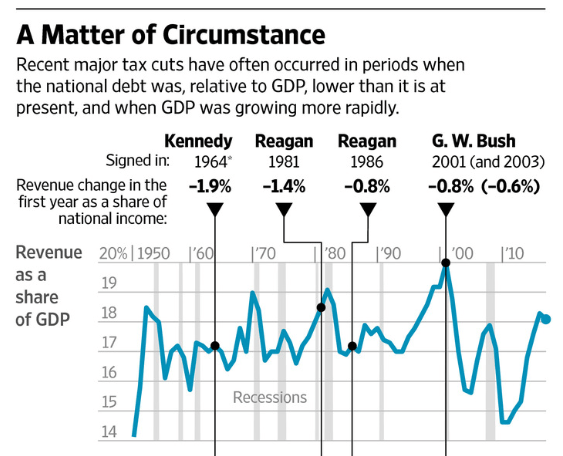

The first problem, slow growth, is being addressed by the Trump Administration with various deregulatory actions as well as likely tax reform action by Congress. Furthermore, the current low 4.4% unemployment rate means that the labor market is tightening on its own.

The second problem, massive debt, is much more worrisome for the future. Right now interest rates are so low that our entire debt is essentially “free” money. But every 1% increase will add nearly $150 billion per year in interest payments. And this continues indefinitely (and keeps getting worse with more debt) because debt is rarely if ever paid back, it is only rolled over! What are the likely outcomes of such an upward spiral in interest payments? There are two possibilities:

- First, the unthinkable. We default on our debt. This would immediately end the role of the U.S. dollar as the international currency and end our superpower status. The fallout would be disastrous for world peace and stability.

- Second, a huge tax increase. The only alternative to default will be a large tax increase just to keep afloat on interest payments. A likely new tax for this purpose is a consumption tax in the form of a value added tax.

Conclusion. It is extremely shortsighted to keep on delaying a necessary solution to our rapidly worsening debt problem. It’s going to be unpleasant to either cut back on spending or to raise taxes but the longer we delay action the more painful it will become in the end. Isn’t it obvious that we should get started immediately?