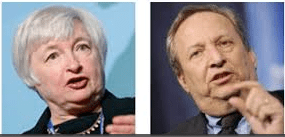

There is an informative article in the May 12, 2016 issue of Bloomberg Businessweek, “How to Pull the World Economy out of Its Rut.” Recall that Janet Yellen succeeded Ben Bernanke as Chair of the Federal Reserve in January 2014. The other candidate for the post was Larry Summers.

They have rather different views about the role of a central bank:

They have rather different views about the role of a central bank:

- Janet Yellen insists that economic conditions are returning to normal, even if slowly. She is neutral about the slow growth, secular stagnation hypothesis and using fiscal stimulus to overcome it.

- Larry Summers argues that world growth is stuck in a rut because there is a chronic shortage of demand for goods and services. Growing inequality puts a bigger share of the world’s income in the hands of rich people who spend less. The new economy is asset-lite (Uber and Airbnb prosper by exploiting existing assets) and so needs less investment. Software doesn’t require the construction of new factories. He thinks that central bankers should spend more time and effort trying to influence fiscal policy. For example, more government spending on infrastructure, global warming and improving education. Also changing the tax code to put more money in the hands of lower- and middle-income families who would spend it.

I think that they are both partly right and partly wrong.

- Janet Yellen is correct in believing that the Fed should stick to monetary policy. But she is too cautious in raising interest rates back to more normal levels. There will be some (stock market) pain in accomplishing this but it needs to be pushed faster regardless.

- Larry Summers is correct in calling for action on the fiscal front. But his suggestions for how to do this are mostly off base because they will lead to massive new debt which must be avoided.

So what is the proper course to get out of our economic rut? It is what I’ve been saying over and over again but I’ll repeat it for good measure in my next post! Stay tuned!