In the midst of a tumultuous presidential campaign season, it iscommon for partisans of the left and the right to question the integrity, motives and values of those on the other side of the political divide. For example, the rise of Donald Trump in the Republican primaries has led some observers to declare that the Republican Party has lost its way and no longer has any sort of basic, coherent and broadly acceptable political philosophy.

On the contrary, I think that Republicans do by and large share the following two general attitudes towards government which are favorite topics of discussion on this blog:

- Economic growth in recent years has been much too slow and it should be a major goal of government to substantially speed it up.

- Our national debt is much too high and Congress and the President should be making serious efforts to balance the budget on an annual basis.

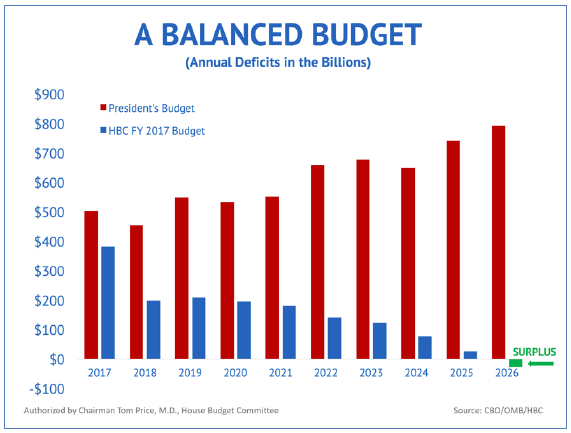

The House Budget Committee has just made a big contribution towards the second goal with, “A Balanced Budget for a Stronger America. Fiscal Year 2017 Budget Resolution.”

Here are its basic components:

Here are its basic components:

- The federal budget will be brought into balance over a ten year period.

- Devolving power back to the states.

- Prioritizing the responsibilities of the federal government and concentrating on the most important.

- Strengthening government functions that are critical to the health, retirement and economic security of millions of Americans.

Such a budget plan as this could make an excellent first step towards an eventual bipartisan agreement that would address some of our country’s biggest problems. Instead it is likely to be ridiculed or dismissed by the Democratic Party as mere political posturing by the Republican majority in Congress. What could be a beginning to real progress on urgent issues will probably just be washed down the drain.

Follow me on Twitter: https://twitter.com/jack_heidel

Follow me on Facebook: https://www.facebook.com/jack.heidel.3