Today’s New York Times has an article “U.S. Economic Recovery Looks Distant as Growth Stalls”, summarizing the predominant view of economic experts that annual growth of the U.S. economy in the future is now expected to be only 2.1%, about two-thirds of the historical rate of 3%.

This is, of course, disappointing since it means continued stagnation of household incomes as well as high unemployment. Much of the projected decline in GDP growth is attributed to structural factors such as:

This is, of course, disappointing since it means continued stagnation of household incomes as well as high unemployment. Much of the projected decline in GDP growth is attributed to structural factors such as:

- The number of Americans receiving disability benefits has increased significantly in recent years. Few of these people will ever return to work.

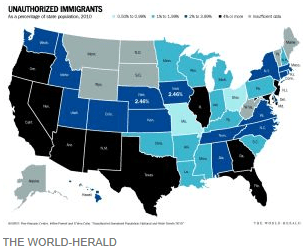

- Fewer immigrants are arriving. There are now two million fewer people over the age of 16 than had been projected in 2007.

- The birth rate has declined each year from 2007.

- Government spending on public investment has fallen by 8% since the recession started. Corporate investment has been lackluster.

- Fewer businesses are being created and existing businesses are spending less on research and development.

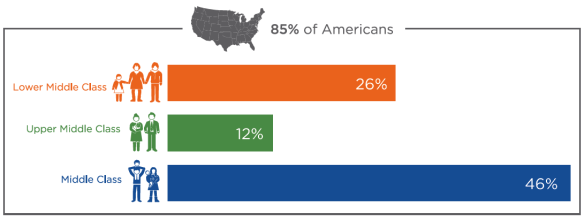

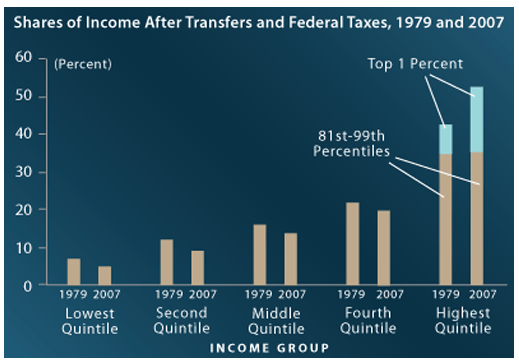

- Rising income inequality results in “secular stagnation” whereby there is insufficient consumer spending to stimulate economic growth.

There are lots of head winds slowing down the economy. As the NYT article says, “for more than a century the pace of growth was reliably resilient, bouncing back after recessions like a car returning to its cruising speed after a roadblock.” Treasury Secretary Jacob Lew says that the government now expects annual growth to be permanently slower.

Should we resign ourselves to this pessimistic attitude or should we consider whether or not there is any practical and feasible alternative?

There is, in fact, an easy way to speed up growth. Broad-based tax reform would do it. By this I mean lowering tax rates across the board paid for by closing loopholes and shrinking the deductions which primarily benefit the wealthy. This would place more income in the hands of the two-thirds of taxpayers who do not itemize deductions. These are typically middle and lower income folks with stagnant incomes. They would spend their tax savings, thereby giving the economy a big boost.

This would also amount to redistribution from the rich to the poor, making us a more equal society in the process. It’s a win-win for our economy and for social harmony. What’s holding us back?