Americans are very fortunate indeed to live in such a strong, prosperous and free society. But not all of us share in this good fortune. How can we help the less fortunate among us have a better chance to succeed in life?

Here are several things we can do, in rough order of importance:

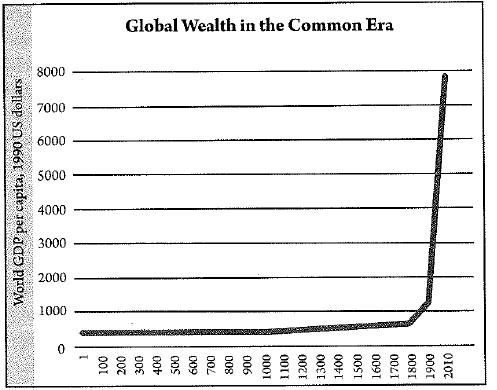

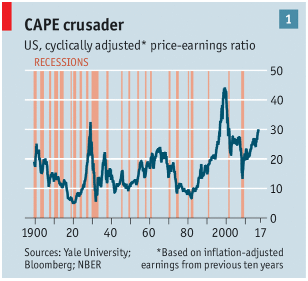

- Grow the economy faster than the 2.1% growth rate which has prevailed since the end of the Great Recession in June 2009. Faster growth means more new jobs are created and higher wages are paid for existing jobs. Success in life for most people includes earning an adequate income to live comfortably without major wants. Appropriate deregulation and tax reform are the best ways to speed up growth.

- Improve basic education so that more people can qualify for rewarding jobs. Right now too many kids from minority and other low-income families are not graduating from high school with the skills they need to succeed in life. Two promising solutions to this problem are more charter schools and expanded early childhood education, both targeted at kids from low-income families.

- Alleviate poverty in a productive manner by emphasizing work requirements for most, if not all, welfare programs. Higher work force participation and lower poverty rates are strongly correlated. Work not only provides income but also provides dignity and purpose in life.

- Promote two parent families. Two parent families are much less likely to be poor than single parent families and also more likely to be supportive of their children’s education. Federal tax policy should always encourage child raising by two parent families for this reason.

Conclusion. America will become an even stronger country than it already is if more people, especially from low-income and minority families, have the education, work training and personal qualities to make a positive contribution to society.