Frontline’s two part series, “The Divided States of America” makes the case that the divisive and hyper-partisan political atmosphere of the past eight years was caused primarily by the racially tinged reaction of the extremist Tea Party to the progressive policies of a forward looking, if inexperienced, black president.

I think that Frontline has missed the most fundamental reasons for our current malaise, namely that:

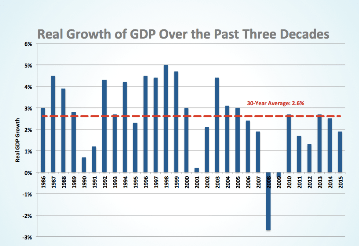

- Slow economic growth since the end of the Great Recession in June 2009 has caused great angst and resentment amongst middle-income, and especially blue-collar, workers who have stagnant incomes when they observe all around them the elite professional, managerial and financial classes who are doing so well.

- Self-righteous attitude of progressives who refuse to accept that conservatives have legitimate, and maybe even superior, points of view on various issues.

For example:

- National Debt. The public debt (on which we pay interest) is now 76% of GDP, the highest since the end of WWII, and is projected by the Congressional Budget Office to keep steadily getting worse without a change in policy. Right now, with ultra-low interest rates, our $14 trillion debt is essentially “free” money. But what is going to happen when interest rates go back up to more normal levels? It could easily be a new fiscal crisis, much worse than the financial crisis of 2008.

- Inequality. Inequality has risen somewhat in recent years but slow growth is the real problem. What is especially lacking is new business investment to increase labor productivity. The best way to fix this is with tax reform (lower tax rates paid for by shrinking deductions) and a reduction in government regulation. But this would mean more “trickle down” economics. Horrors!

- Improving Obamacare. The Affordable Care Act has increased access to healthcare but has done nothing to control costs. Most developed countries control the cost of healthcare with a “single payer,” government run monopoly. But this is anathema to many Americans who neither want to give up personal choice nor want to forgo the innovation which a free-market consumer-driven healthcare system provides.

Conclusion. The driver of our currently divisive political climate is a deep chasm between the fundamental beliefs of the two different sides. How can this deep division be overcome short of a new crisis which pulls both sides together? A very difficult question.

Follow me on Twitter

Follow me on Facebook