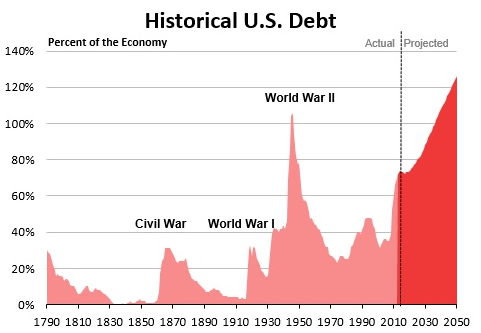

As I like to remind readers, I am a fiscal conservative and a social moderate. I started writing this blog in November 2012, after running unsuccessfully in a Republican congressional primary in May of that year. I am appalled by our reckless fiscal policies in recent years. We simply have to get federal spending in much better alignment with tax revenue and do this in a relatively short period of time.

Both political parties are responsible for our current predicament. Nevertheless, we need to have the best factual information available to help us get back on track. Today I compare the Bush deficits with the Obama deficits. The most objective way to do this, in my opinion, is to divide the transition budget years, 2001 and 2009, between the incoming and outgoing presidents. In other words, October, November and December of the year 2000 are assigned to President Clinton and the last nine months of the 2001 budget year, i.e. January 2001 – September 2001, are assigned to President Bush. Likewise for the 2009 budget year, when Bush was leaving office and President Obama was coming in.

A good source for such detailed budget information is the website of David Manuel, “an online repository of financial and political information that is often searched for but is generally hard to find.”

A good source for such detailed budget information is the website of David Manuel, “an online repository of financial and political information that is often searched for but is generally hard to find.”

Here is what I’ve come up with:

President Bush

- 2001 budget year (last 9 months) $129.6 (billion) surplus

- 2002 budget year $157.8 (billion) deficit

- 2003 budget year $377.6 (billion) deficit

- 2004 budget year $413 (billion) deficit

- 2005 budget year $318 (billion) deficit

- 2006 budget year $248 (billion) deficit

- 2007 budget year $161 (billion) deficit

- 2008 budget year $459 (billion) deficit

- 2009 budget year (first 3 months) $332.5 (billion) deficit

- $2,337.3 (billion) deficit TOTAL

President Obama

- 2009 budget year (last 9 months) $1080.5 (billion) deficit

- 2010 budget year $1294 (billion) deficit

- 2011 budget year $1299 (billion) deficit

- 2012 budget year $1100 (billion) deficit

- 2013 budget year $ 683 (billion) deficit

- 2014 budget year $ 483 (billion) deficit

- 2015 budget year (CBO estimate) $ 468 (billion) deficit

- 2016 budget year (CBO estimate) $ 467 (billion) deficit

- 2017 budget year (first 3 months, CBO) $ 163 (billion) deficit

- $7,037.5 (billion) deficit TOTAL

These totals represent, of course, the amounts that were added (Bush) or will be added (Obama) to the national debt during their terms of office. George Bush made little, if any, effort to control deficit spending. But the Obama debt is three times as bad as the Bush debt. Getting the debt under control is by far our biggest and most urgent national problem. By failing to take our debt seriously, both Bush and Obama have been huge failures as president!