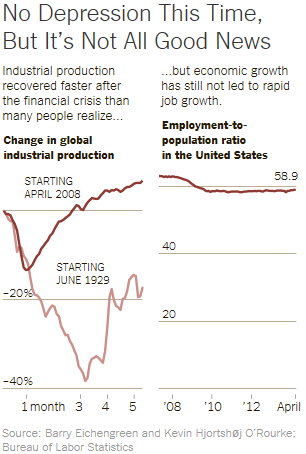

It is widely deplored that wages for both middle- and lower-income workers are stagnant and have not even recovered from where they were before the beginning of the Great Recession. The latest issue of The Economist explores this problem, “When what comes down doesn’t go up.”

The Economist sees several factors at work:

The Economist sees several factors at work:

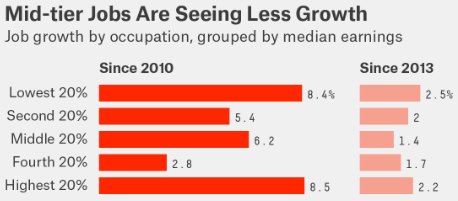

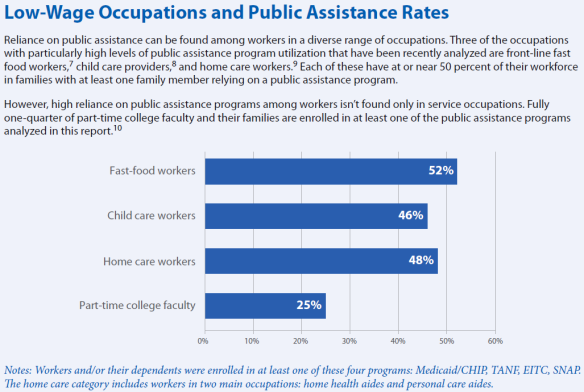

- As the unemployment rate continues to drop, many new jobs are paying less than the old jobs that were lost.

- In Germany “mini jobs,” paying under $440 per month, are skyrocketing. In Britain “zero hours” contracts, with no commitment to a fixed number of hours, are becoming more common.

- In 2013 Kelly Services, which provides temporary workers, was the second largest employer in the U.S. with a staff of 750,000. 2.9 million temps account for 2% of all jobs in the U.S.

As The Economist points out, if low pay does in fact lock in, inflation will stay low even as the unemployment rate continues to fall. The Federal Reserve will then be likely to keep interest rates low indefinitely as well. But this means there will be far less incentive for Congress and the President to cut back on huge deficit spending because debt is almost “free money” when interest rates are low. Long term, massive debt, is a huge threat to our security and prosperity.

Breaking out of this pernicious low wage trap will require a bold effort by Congress and the President to boost economic growth. By far the best way to do this is with broad-based tax reform at both the individual and corporate levels. As I have discussed in previous posts, what is needed is lower tax rates paid for by closing loopholes and deductions. Hopefully, the new Congress is headed in this direction!