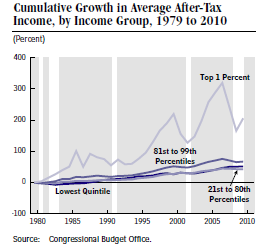

My last post, “The Politics of Distrust” presents the view that the main reason for the divisiveness of today’s politics is “the stubborn torpor of the American economy.” If this is true then the solution is obvious: speed up economic growth!

A couple of weeks ago the economist Alan Blinder, a Hillary Clinton advisor, had an Op Ed in the Wall Street Journal, “A Fairness Agenda for Winning Over Angry Voters” with which I largely agree. Here are the highlights of Mr. Blinder’s fairness agenda:

A couple of weeks ago the economist Alan Blinder, a Hillary Clinton advisor, had an Op Ed in the Wall Street Journal, “A Fairness Agenda for Winning Over Angry Voters” with which I largely agree. Here are the highlights of Mr. Blinder’s fairness agenda:

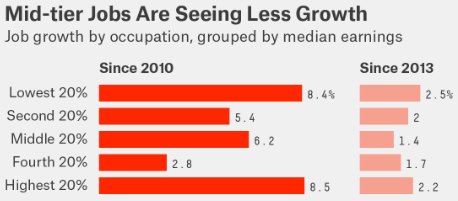

- A labor market tight enough to leave employers scouring the land for workers, the best tonic for workers the world has ever known. Mr. Blinder does say that looser purse strings by Congress would help create more demand but it is simply too risky to keep running up our already enormous national debt. Eventually interest rates will return to normal and interest payments on the debt will skyrocket.

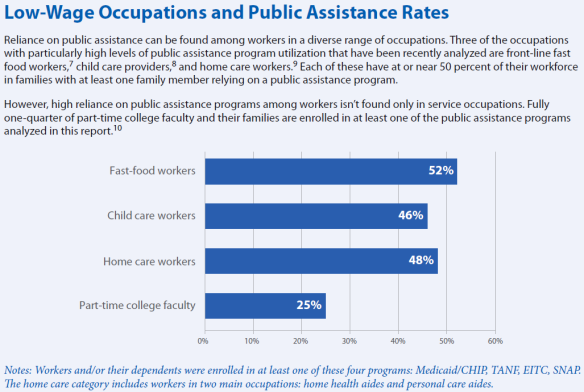

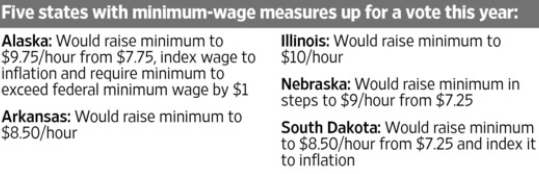

- Raising the federal minimum wage would be an enormous help for wage earners at the bottom. Many states and cities are doing this on their own which is a better way to go because of huge regional differences.

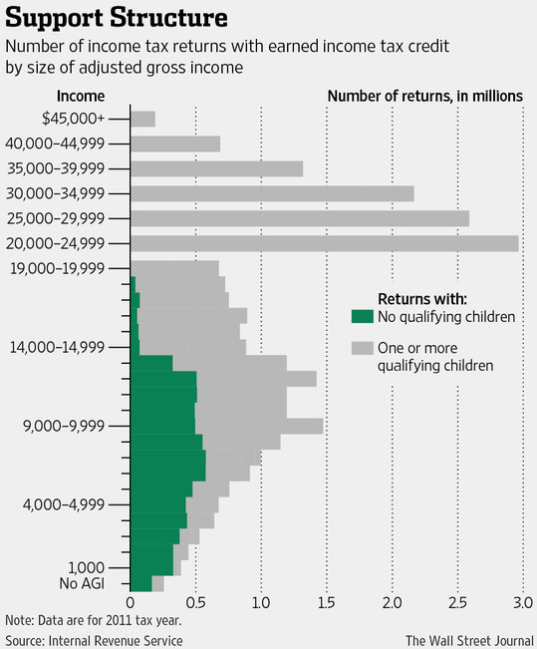

- Increase the Earned Income Tax Credit, especially for childless workers. A very good way to incentivize work.

- More Vocational Training and Apprenticeships. Strengthening community colleges and career education in high schools would go a long way to accomplish this.

- Provide quality pre-K education for families who can’t afford it. Early childhood education for children from low-income families is another very good idea.

- The tax code is a national disgrace. The corporate tax may be even more complex, inefficient and unfair than the personal tax. The mantra of tax reformers has always been: broaden the base, lower the rates. Amen!

What Mr. Blinder is calling a fairness agenda turns out to be a growth agenda in disguise. I would add a few more items like deregulation to encourage entrepreneurship and business expansion but basically Mr. Blinder has suggested an attractive program for economic growth which should appeal to a broad collection of political interests.

Follow me on Twitter: https://twitter.com/jack_heidel

Follow me on Facebook: https://www.facebook.com/jack.heidel.3