As I indicated in my last post, ”Entitlement Spending and the National Debt,” our national debt is much too high and steadily getting worse. Furthermore, it is entitlement spending, especially Medicare, which is the fundamental driver of our increasing debt. If we don’t solve this problem relatively soon, we will have another financial crisis on our hands, much worse than the last one in 2008. When interest rates go up, as they will sooner or later, then interest payments on our accumulated debt will rise precipitously and threaten to bankrupt the nation.

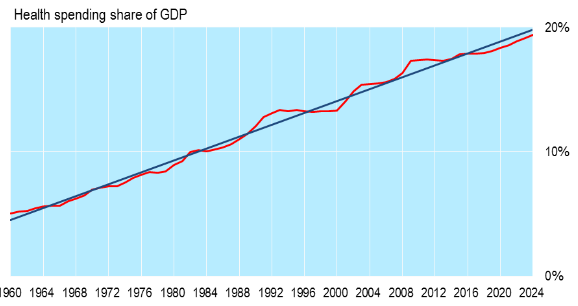

The only effective way to control Medicare costs, however, is to control the overall cost of healthcare in the U.S., i.e. for private healthcare. The above chart shows the nature of this problem. Right now we are spending 17.4% of GDP on healthcare, public and private, and this is predicted to reach 19.6% of GDP by 2024. This is almost twice as much as for any other developed country.

The only effective way to control Medicare costs, however, is to control the overall cost of healthcare in the U.S., i.e. for private healthcare. The above chart shows the nature of this problem. Right now we are spending 17.4% of GDP on healthcare, public and private, and this is predicted to reach 19.6% of GDP by 2024. This is almost twice as much as for any other developed country.

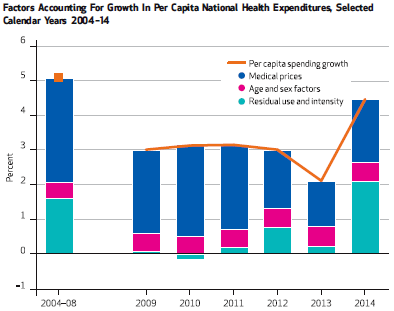

The Omaha World Herald had an article on Sunday, “Bending the Curve,” purporting to show that cost increases for total national healthcare spending are dropping (see just above). The problem is that these supposedly low price increases in recent years are still twice the rate of inflation which is now averaging under 2% per year. This means that even 4% – 5% price increases per year are much too high and need to be curtailed even further.

The Omaha World Herald had an article on Sunday, “Bending the Curve,” purporting to show that cost increases for total national healthcare spending are dropping (see just above). The problem is that these supposedly low price increases in recent years are still twice the rate of inflation which is now averaging under 2% per year. This means that even 4% – 5% price increases per year are much too high and need to be curtailed even further.

The fundamental reason why U.S. healthcare is so expensive is that Americans do not have enough “skin in the game.” The above chart shows that our direct out-of-pocket costs for healthcare have been steadily dropping for the last fifty years as the role of health insurance has expanded. This means that we simply don’t have enough personal incentive to hold down healthcare spending on our own.

The fundamental reason why U.S. healthcare is so expensive is that Americans do not have enough “skin in the game.” The above chart shows that our direct out-of-pocket costs for healthcare have been steadily dropping for the last fifty years as the role of health insurance has expanded. This means that we simply don’t have enough personal incentive to hold down healthcare spending on our own.

Conclusion: We have to control entitlement spending, especially for Medicare, to get our national debt under control. But this can only be done by limiting the steep spending increases in overall healthcare, public and private. How will we be able to do this? Be patient, we’re getting there!