I did not vote for Donald Trump because of his often crude remarks and sleazy behavior. But I am now cautiously optimistic about the prospects for his presidency based on the quality of his nominees for important government posts. Like many of his voters, I “take him seriously but not literally.”

Here is what I think he will do:

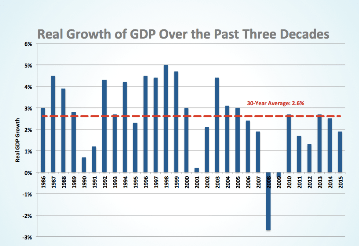

- Economic Policy. He will try to speed up economic growth, well above the average 2.1% annual GDP growth of the past 7½ years. This can be accomplished with tax reform (lowering tax rates paid for by shrinking deductions), regulatory reform (including paring back Dodd-Frank and the ACA), immigration reform and tougher trade policies. Faster growth benefits the whole country and especially the blue-collar workers who voted for him.

- Improving life in the inner cities. K-12 education is a disaster in many inner cities and Betsy DeVos will be a reformer in the Education Department. Ben Carson grew up in public housing and is an excellent choice for HUD.

- Foreign Policy. Mr. Trump wants changes from China on currency and trade practices. He also wants more cooperation from Russia in fighting terrorism. He wants our NATO partners to bear a bigger share of their own defense. His Secretary of State designee, Rex Tillerson, supports arming Ukraine against Russia and also supports the TPP trade agreement with Asia. This all sounds good to me.

- Fiscal Policy. My biggest concern at this point is our national debt, now 76% of GDP (for the public part on which we pay interest) which is historically high and steadily getting worse. The House Republicans are serious about shrinking deficit spending and hopefully Mr. Trump will support their efforts.

Conclusion. Donald Trump has a highly unconventional (but very effective) style of communication. If it leads to progress in addressing our biggest problems as above, then he’ll have a very successful presidency.