The Republican tax bill has now come out of conference and will soon be voted on by both the House and the Senate. It is expected to easily pass both chambers and be signed by the President. As I have discussed extensively on this blog, I have no argument with the individual features of this bill. They will definitely increase economic growth which is highly desirable.

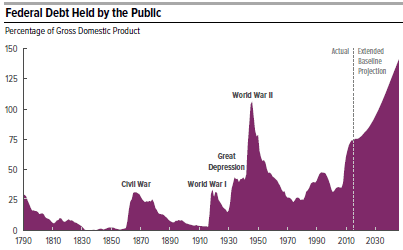

The problem is that the tax bill will also add $1 trillion to the debt over ten years (as scored by the JCT). It is simply outrageous for the GOP to consciously add $1 trillion to our already $15 trillion debt (the public part on which we pay interest), which at 77% and climbing, is the highest it has been since right after WWII.

But the damage will be even worse than this. The trillion dollar artificial stimulus is likely to overheat an already briskly growing economy. As the Economist reports in its latest issue:

- Second quarter growth of 3.1% and third quarter growth of 3.3% are very strong.

- Median household income grew 5.2% in 2015 and 3.2% in 2016.

- The average net worth of households in the middle income quintile grew by 34% between 2013 and 2015.

- The wages and salaries of production workers grew at a 3.8% pace in the third quarter of 2017.

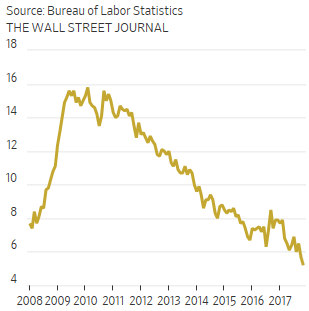

- The unemployment rate at the end of 2018 is likely to be between 3.4% and 3.8%.

Economic growth is good because it raises living standards across the board. But faster growth also means higher inflation which means higher interest rates as the Federal Reserve responds. Higher interest rates mean higher interest payments on our massive debt. Every time the Federal Reserve raises interest rates by ¼ %, the interest payments on our debt will increase by about $38 billion per year. A 2% increase in interest rates, likely within two years, means a $300 billion increase in annual interest (on top of the $266 billion paid in FY 2017). Our massive debt will soon become a huge burden for the federal budget.

Conclusion. Adding $1 trillion to the debt on top of the existing debt is a terrible idea. Such artificial stimulus at a time when GDP growth is already picking up will drive up interest rates all the faster and greatly speed up the day of reckoning for extreme fiscal irresponsibility.