Last week’s report from the Congressional Budget Office “The Economic Outlook: 2014 – 2024” (which I discussed in my last post) caused a big stir with its prediction that ObamaCare will cause a loss of 2,000,000 mostly low wage jobs by 2017 and 2,500,000 such jobs by 2024. The lost jobs aren’t necessarily from workers being fired or fewer workers being hired but rather the overall decreased incentive for individuals to find work. The CBO analysis is based on the research of the economist Casey Mulligan featured in yesterday’s Wall Street Journal as “The Economist Who Exposed ObamaCare”.

The above chart of Mr. Mulligan interprets several recent government subsidy programs as a new marginal tax rate, i.e. the “extra taxes paid and government benefits foregone as a result of earning an extra dollar of income.” The 2009 stimulus, the Recovery and Reinvestment Act, had an effect like this but it was temporary. The marginal tax increase of the Affordable Care Act will last as long as it remains in effect.

The above chart of Mr. Mulligan interprets several recent government subsidy programs as a new marginal tax rate, i.e. the “extra taxes paid and government benefits foregone as a result of earning an extra dollar of income.” The 2009 stimulus, the Recovery and Reinvestment Act, had an effect like this but it was temporary. The marginal tax increase of the Affordable Care Act will last as long as it remains in effect.

The above chart from the same CBO report, showing the steady decline in the Labor Force Participation Rate from the year 2000 onward, demonstrates the critical nature of this problem. Lower labor force participation means lower growth in overall labor productivity which in turn means slower economic growth. Since the Great Recession ended in June 2009, GDP growth has averaged only about 2% annually.

The above chart from the same CBO report, showing the steady decline in the Labor Force Participation Rate from the year 2000 onward, demonstrates the critical nature of this problem. Lower labor force participation means lower growth in overall labor productivity which in turn means slower economic growth. Since the Great Recession ended in June 2009, GDP growth has averaged only about 2% annually.

Slow GDP growth means, in addition to a higher unemployment rate, that America’s standard of living will not increase very rapidly if at all. But the problem is really much worse than this. We have an enormous debt problem which is only getting worse every year that we continue to have large deficits. The CBO report predicts increasing growth in the size of our national debt. By far the least painful way of shrinking our debt (relative to the size of the economy) is to grow the economy as fast as we reasonably can. But our economy is actually slowing down, not speeding up!

This is a very serious problem which many of our national leaders are much too complacent about!

Category Archives: Wall Street Journal

A Global Perspective on Income Inequality

In connection with the annual World Economic Forum in Davos Switzerland, the World Bank has published a breakdown of income growth around the world, as reported yesterday by the Wall Street Journal in the article “Two-Track Future Imperils Global Growth”. The key finding, as shown in the chart below, is that it is precisely the middle class in the developed nations which saw the slowest income growth in the years from 1998-2008.

It is clear from this chart what is going on around the world. The top 1% makes its money from capital investments and historically the return on capital exceeds economic growth. The next 9% are both the skilled workers and the educated professionals who are benefitting from the growth of knowledge industry. The medium skilled middle class in the developed world, from the 75th percentile through the 90th percentiles, are the ones who are seeing the smallest income gains. Their jobs are being eliminated by the force of globalization which is shifting lower skilled work to lower paid workers in the developing world.

It is clear from this chart what is going on around the world. The top 1% makes its money from capital investments and historically the return on capital exceeds economic growth. The next 9% are both the skilled workers and the educated professionals who are benefitting from the growth of knowledge industry. The medium skilled middle class in the developed world, from the 75th percentile through the 90th percentiles, are the ones who are seeing the smallest income gains. Their jobs are being eliminated by the force of globalization which is shifting lower skilled work to lower paid workers in the developing world.

The article points out, consistent with the above chart, that the income, including benefits, of the poorest 50% in the U.S. grew 23% in this same time period. So it really is the middle class which is hurting the most in the U.S. There are three basic ways of addressing this problem:

- The federal government can help by taking much stronger measures to boost the economy thereby creating more jobs as well as higher paying jobs. Tax reform, trade expansion, immigration reform and fiscal stability are what is needed to get this job done.

- The states can help by improving our K-12 education system to make sure that everyone acquires the basic academic skills, such as reading and math, which they will need to achieve their highest potential in life.

- All concerned and aware individuals (such as ourselves!) must constantly beat the drums to encourage young people to stay in school and take learning seriously.

America is “exceptional” because it is the strongest, freest, and wealthiest country the world has ever known. But our future success is by no means guaranteed. We have to constantly work for it and earn it!

Harnessing Market Forces versus Offsetting Market Forces

The economist Matthew Slaughter writes in today’s Wall Street Journal that ’High Trade’ Jobs Pay Higher Wages. He points out that the 22.9 million Americans who work for U.S. headquartered multinational companies made an average of $73,338 in 2011 compared with the overall average wage of about $55,000 that year. “Workers in multinational firms earn more, as global engagement fosters innovation and productivity growth.”

“There is a growing concern about stagnant or falling incomes, yet most of the measures proposed to deal with the issue – raising the minimum wage and reinstating unemployment benefits – purport to help workers by offsetting market forces. Less attention is given to harnessing market forces.”

This can be done by “liberalizing U.S. trade, investment, immigration and tax policies.” In other words, we need more trade agreements like NAFTA, which has been so successful in increasing trade in North America. We need more high skilled workers, both domestic and foreign. We need lower corporate tax rates to encourage multinational corporations to bring their trillions of dollars in overseas profits back home.

This can be done by “liberalizing U.S. trade, investment, immigration and tax policies.” In other words, we need more trade agreements like NAFTA, which has been so successful in increasing trade in North America. We need more high skilled workers, both domestic and foreign. We need lower corporate tax rates to encourage multinational corporations to bring their trillions of dollars in overseas profits back home.

We should always strive for a more equal society with less income inequality. But the best single way to do this is to create more opportunity by growing the economy, i.e. by harnessing market forces.

Should Government Address Inequality Directly?

Wall Street Journal columnist William Galston suggests in “Where Right and Left Agree on Inequality”, that both sides of the political spectrum agree that economic inequality is increasing in America and that government needs to address this problem. “Poverty is part of the explanation, as liberals insist. But so are parenting and family structure, as conservatives believe.”

It so happens that we have a broadly supported federal program which simultaneously addresses both poverty and family structure. It is the Earned Income Tax Credit program. It provides $3,305 a year to low-income working families with one child and up to $6,143 for families with three or more children. The U.S. spends $61 billion a year on this program and it has proven to be very successful in encouraging low-income people to find and keep jobs. In fact, the economist, Gregory Mankiw, recommends the EITC over a higher minimum wage as a better way to increase the earnings of the working poor.

It so happens that we have a broadly supported federal program which simultaneously addresses both poverty and family structure. It is the Earned Income Tax Credit program. It provides $3,305 a year to low-income working families with one child and up to $6,143 for families with three or more children. The U.S. spends $61 billion a year on this program and it has proven to be very successful in encouraging low-income people to find and keep jobs. In fact, the economist, Gregory Mankiw, recommends the EITC over a higher minimum wage as a better way to increase the earnings of the working poor.

The New York Times’ Eduardo Porter reports in “Seeking Ways to Help the Poor and Childless”, that New York City is conducting an experiment to see if a locally run program similar to the EITC will have the same positive effect in increasing employment of childless adults. It is understood that many of the jobs being created in today’s economy are low paying service jobs. As Mr. Porter says, “for the American market economy to remain viable, being employed must, one way or another, provide for workers’ needs.”

Conclusion: as important as it is for Congress and the President to adopt measures to increase economic growth (e.g. tax reform, fiscal stability, expanded foreign trade, immigration reform), in order to create more and better paying jobs, government also has a responsibility to provide direct help to the needy who are trying to help themselves. The EITC program is an excellent way to do this!

How Do We Increase Economic Mobility?

As the Wall Street Journal reported several days ago, “Economic Mobility Is the New Flashpoint”. “Both parties agree the opportunity gap is widening, but the proposed solutions are starkly different.” The Democrats want to increase the minimum wage, extend unemployment benefits, and expand access to college. The Republicans suggest a whole potpourri of approaches such as reforming welfare (including food stamps), extending school choice, cutting taxes, and relaxing regulations on new businesses.

A look at the latest jobs report from the Labor Department should provide the focus which Congress needs to figure out how to increase economic opportunity. Although the unemployment rate dropped substantially to 6.7% from 7.0% at the beginning of December, only 74,000 new jobs were created in December. The explanation is that 347,000 left the labor force last month. The labor force participation rate, the share of the U.S. working-age population employed, age 16 and over, has dropped from 64.5% in 2000, to just under 63% at the beginning of 2008 to near a post-recession low of 58.6% last month (see chart below).

In other words, Congress should be totally focused on speeding up economic growth in order to create more jobs. Since new businesses create the most new jobs, we should indeed relax as many regulations as possible which impede entrepreneurship. We should lower the corporate tax rate from its very high current value of 35% to get American multinational companies to bring their trillions of overseas profits back home for reinvestment in the U.S. Moving to a national consumption tax (see the Graetz Plan discussion in my January 7 post), could mean dropping the corporate tax rate to as low as 15%.

In other words, Congress should be totally focused on speeding up economic growth in order to create more jobs. Since new businesses create the most new jobs, we should indeed relax as many regulations as possible which impede entrepreneurship. We should lower the corporate tax rate from its very high current value of 35% to get American multinational companies to bring their trillions of overseas profits back home for reinvestment in the U.S. Moving to a national consumption tax (see the Graetz Plan discussion in my January 7 post), could mean dropping the corporate tax rate to as low as 15%.

Isn’t is obvious that the best thing we can do to give low income people an opportunity to rise up the economic ladder is to just give them a job in the first place? If they’re ambitious they’ll take any opportunity they can get and run with it!

Oklahoma’s Senator Tom Coburn: We Need More like Him!

Senator Tom Coburn of Oklahoma has an Op Ed column in the Wall Street Journal from two days ago “The Year Washington Fled Reality”, discussing many of the things that are wrong with our national government. Granted that all elected officials “play politics” to some extent or another, nevertheless Dr. Coburn, an obstetrician, is amazingly independent of the reigning political culture. He spent three consecutive terms in the House of Representatives, left Congress for four years, and now is back serving his second term in the Senate. He has announced that he will not run for re-election in 2016 when his present term ends.

Dr. Coburn is constantly drawing attention to, and attacking, the enormous amount of wasteful and inefficient spending approved by Congress. The Popular Romance Project, pictured above, is an example. His office has just published its fourth annual report on government waste, “Wastebook 2013”, detailing 100 different “examples of government mismanagement and stupidity. … Collectively these cost nearly $30 billion in a year when Washington would have you believe everything that could be done, has been done to control unnecessary spending.”

Dr. Coburn is constantly drawing attention to, and attacking, the enormous amount of wasteful and inefficient spending approved by Congress. The Popular Romance Project, pictured above, is an example. His office has just published its fourth annual report on government waste, “Wastebook 2013”, detailing 100 different “examples of government mismanagement and stupidity. … Collectively these cost nearly $30 billion in a year when Washington would have you believe everything that could be done, has been done to control unnecessary spending.”

Dr. Coburn has prevailed upon the Government Accounting Office to issue annual reports called “Actions Needed to Reduce Fragmentation, Overlap and Duplication and Achieve Other Financial benefits.” Three of these reports have now been issued. Altogether they list almost 400 individual actions which could be taken to improve the efficiency and effectiveness of 162 different program areas.

In spite of all the good work he is doing, Dr. Coburn would be even more effective if he had more help. Fiscal conservatives should stop wasting their time on senseless gestures like trying to defund Obamacare. They need to get down in the trenches with serious deficit hawks like Tom Coburn and whittle away at wasteful programs one by one.

Is the American Middle Class in Decline?

Many political commentators have been complaining recently about the financial difficulties of the American middle class. For example, a recent report from Bill Moyers and Company, “By the Numbers: The Incredibly Shrinking American Middle Class”, has a chart showing that the median middle class salary, adjusted for inflation, is now no better than it was in 1989 and not much higher than in 1979:

But there is another point of view, very well described by the two economists, Donald Boudreaux and Mark Perry, in the Wall Street Journal just about a year ago, “The Myth of a Stagnant Middle Class”. They make several pertinent points:

But there is another point of view, very well described by the two economists, Donald Boudreaux and Mark Perry, in the Wall Street Journal just about a year ago, “The Myth of a Stagnant Middle Class”. They make several pertinent points:

- The Consumer Price Index overestimates inflation by underestimating the value of improvements in product quality and variety.

- Wage figures ignore the rise over the past few decades in the portion of worker pay taken as (nontaxable) fringe benefits. Health benefits, pensions, paid leave, etc. now amount to almost 31% of total compensation according to the Bureau of Labor Statistics.

- The average hourly wage has been held down by the great increase of women and immigrants into the workforce over the past three decades. Because the economy was (before the Great Recession) so strong, it created millions of jobs for the influx of often lesser skilled workers into the workforce.

Messrs. Boudreaux and Perry point out several other improvements in the quality of life which Americans enjoy:

- Life expectancy has increased to 79 years for an American born today, five years longer than in 1980. And the gap in life expectancy between whites and blacks has narrowed.

- Spending by households on the basics of food, housing, utilities, etc. has shrunk from 53% of income in 1950, to 44% in 1970 to 32% today.

- Although income inequality is rising when measured in dollars, it is falling when measured in terms of our ability to consume. For another example, air travel is now as common as was bus travel in an earlier era. And another: the latest electronic products are available to even middle class teenagers.

Conclusion: We should stop complaining about inequality and thank our lucky stars for the free enterprise system which has been so successful in improving our quality of life.

More on Inequality: What Does the Data Mean?

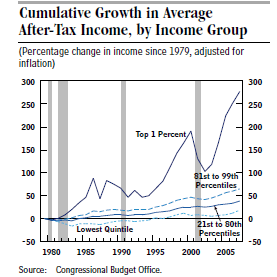

In yesterday’s Wall Street Journal, the economist Robert Grady addresses “Obama’s Misguided Obsession With Inequality”. The basic problem is that an important Congressional Budget Office report in 2011, “ Trends in the Distribution of Household Income Between 1979 and 2007”, is easy to misrepresent and misinterpret. Here are three basic pieces of data from the CBO report:

The first chart shows that yes, between 1979 and 2007 the rich did indeed get richer relative to the rest of the population. The second chart shows, however, that median household income increased by 62% during this same time period. And the third chart shows that all five income groups made substantial gains at the same time.

The first chart shows that yes, between 1979 and 2007 the rich did indeed get richer relative to the rest of the population. The second chart shows, however, that median household income increased by 62% during this same time period. And the third chart shows that all five income groups made substantial gains at the same time.

As Mr. Grady says, “Here is the bottom line. In periods of high economic growth, such as the 1980s and 1990s, the vast majority of Americans gain and have the opportunity to gain. In periods of slow growth, such as the past four and a half years since the recession officially ended, poor people and the middle class are hurt the most, and opportunity is curbed. … The point is this: If the goal is to deliver higher incomes and a better standard of living for the majority of Americans, then generating economic growth – not income inequality or the redistribution of wealth – is the defining challenge of our time.”

So then, what is the best way to address income inequality? Should we concentrate on raising taxes on the rich and increasing spending on social programs like we have done in the last five years? Or should we rather concentrate on speeding up economic growth, as Mr. Grady says, in order to create more jobs and more opportunities for advancement?

Compare the enormous growth in the period from 1979 to 2007 with the stagnation of the past five years. Isn’t it obvious which is the better way to proceed?

How Do We Fight Economic Inequality? By Restoring Growth!

The liberal economist Paul Krugman returns to one of his favorite topics in yesterday’s New York Times, “Why Inequality Matters”. “On average, Americans remain a lot poorer today than they were before the economic crisis. For the bottom 90 percent of families, this impoverishment reflects both a shrinking economic pie and a declining share of that pie.” The problem with Mr. Krugman’s analysis is that he offers no solution beyond more fiscal stimulus: “the premature return to fiscal austerity has done more than anything to hobble the recovery.”

But there is another route to recovery and it is propounded in today’s Wall Street Journal by George Osborne, the United Kingdom’s Chancellor of the Exchequer, “How Britain Returned to Growth”. “We cut spending and top tax rates, and now deficits are down and jobs are being created at a healthy clip … at the rate of 60,000 per month, roughly equivalent to 300,000 in the U.S. … The corporate tax rate is being cut to 20% from 28%. … As a result, more international firms are moving their headquarters to Britain and investment is flowing into our country.”

But there is another route to recovery and it is propounded in today’s Wall Street Journal by George Osborne, the United Kingdom’s Chancellor of the Exchequer, “How Britain Returned to Growth”. “We cut spending and top tax rates, and now deficits are down and jobs are being created at a healthy clip … at the rate of 60,000 per month, roughly equivalent to 300,000 in the U.S. … The corporate tax rate is being cut to 20% from 28%. … As a result, more international firms are moving their headquarters to Britain and investment is flowing into our country.”

Yes, as Mr. Krugman says, economic inequality in the U.S. is bad and getting worse. The question is what to do about it. Shall we try to improve the situation with artificial stimulation, increasing government debt, already very high, for future generations? Or shall we address this inequality by encouraging businesses to grow and expand and thereby raise wages and hire more people.

The good news is that America is the success story of the 20th century. The bad news is that everyone else in the world has figured this out and is now copying our own best methods. Either we can compete, innovate, stay on top and thrive, or else we can get lazy, stagnate and sink down in the pack.

Will it be more inequality or more growth? The choice is up to us!

Is a Bad Deal Better Than No Deal At All?

Beltway insiders are praising the just announced budget deal between the Democrats and the Republicans. For example, a news analysis in today’s Wall Street Journal, “Accord Is Departure for Capitol”, suggests that budget politics may be changing, getting any deal is very hard, that perhaps bipartisanship isn’t dead in Washington but that there is still unfinished business. This is a purely euphemistic assessment. All this deal really does is to let the big spenders off the hook.

What it does is to relax the sequester by $63 billion for the next two years for very little in return. The $84 billion in new fees over ten years “officially” reduces the deficit by $21 billion but two year’s worth of new fees is just $16.8 billion. This means that the deficit will actually increase by $46 billion over the next two years.

But the real problem is that the leverage represented by the sequester is being thrown away for the next two years and this sets a bad precedent for the future. For example, we can now assume that the debt limit will also be raised for two more years in February 2014 because there will no longer be any leverage for bargaining for any other changes.

This in turn means that entitlement reform is for all practical purposes dead for the next two years. This is the really hard problem to solve. Big spenders will do anything to avoid dealing with it. Responsible fiscal conservatives know it must be addressed and need all the help they can muster to get something done.

What happens if the budget deal is not passed by Congress? It simply means that the sequester remains in effect and that discretionary spending will be $43 billion lower this current budget year than otherwise. The value of the sequester is to force action on the really thorny issue of reducing entitlement spending. Let’s preserve it for this purpose and not throw it away for nothing significant in return.

Leaders are supposed to address issues, not walk away from them!