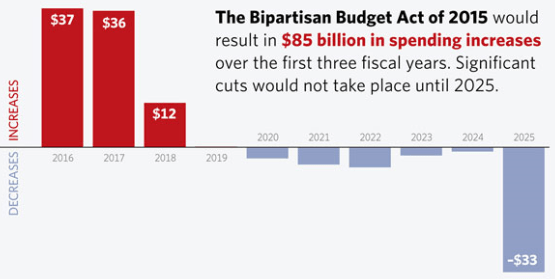

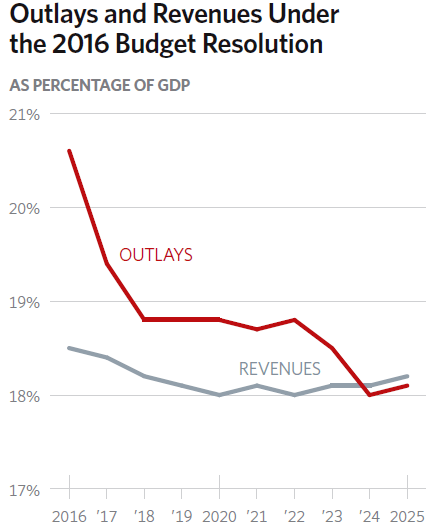

Congress has adjourned for Christmas having passed a final budget for the 2016 Fiscal Year extending through next September. It puts into place for this year the two year spending agreement reached between Congress and the President in October. However Congress started out the year by passing a ten year budget plan resolution leading to a balanced budget by 2025. The budget just passed leads instead to a deficit of $1.1 trillion in 2025.

Here are the details as described by the nonpartisan Committee for a Responsible Federal Budget:

Here are the details as described by the nonpartisan Committee for a Responsible Federal Budget:

- Revenue: decreased under new budget by a $650 billion (over ten years) by making various temporary tax deductions permanent.

- Discretionary Spending: increased by $50 billion for the current budget year (by breaking the sequester cap).

- Medicare: instead of saving $430 billion over ten years, Medicare spending is increased by $95 billion over ten years.

- 2025 Deficit: instead of shrinking to zero in ten years, it is now projected to be more than $1 trillion in 2025.

- 2025 Debt: currently the (public, on which we pay interest) debt is 74% of GDP. The ten year balanced budget plan would reduce the debt to 56% of GDP. Instead, the debt is now on track to reach 80% of GDP by 2025.

Granted the Republican Congress hopes to develop a tax reform plan in 2016 which would lower tax rates for everyone, paid for by closing many of the loopholes and deductions just approved last week. One very good way to do this has recently been proposed by the Tax Foundation. The TF plan would boost economic growth and thereby increase tax revenue substantially over ten years.

The problem is that real tax reform is unlikely to happen without a Republican president in office. If a Democratic president is elected in 2016, then the dire predictions made by the CRFB (above) are likely to remain valid for the foreseeable future. Our fiscal and economic future remains quite precarious at the present time!

Follow me on Twitter: https://twitter.com/jack_heidel

Follow me on Facebook: https://www.facebook.com/jack.heidel.3